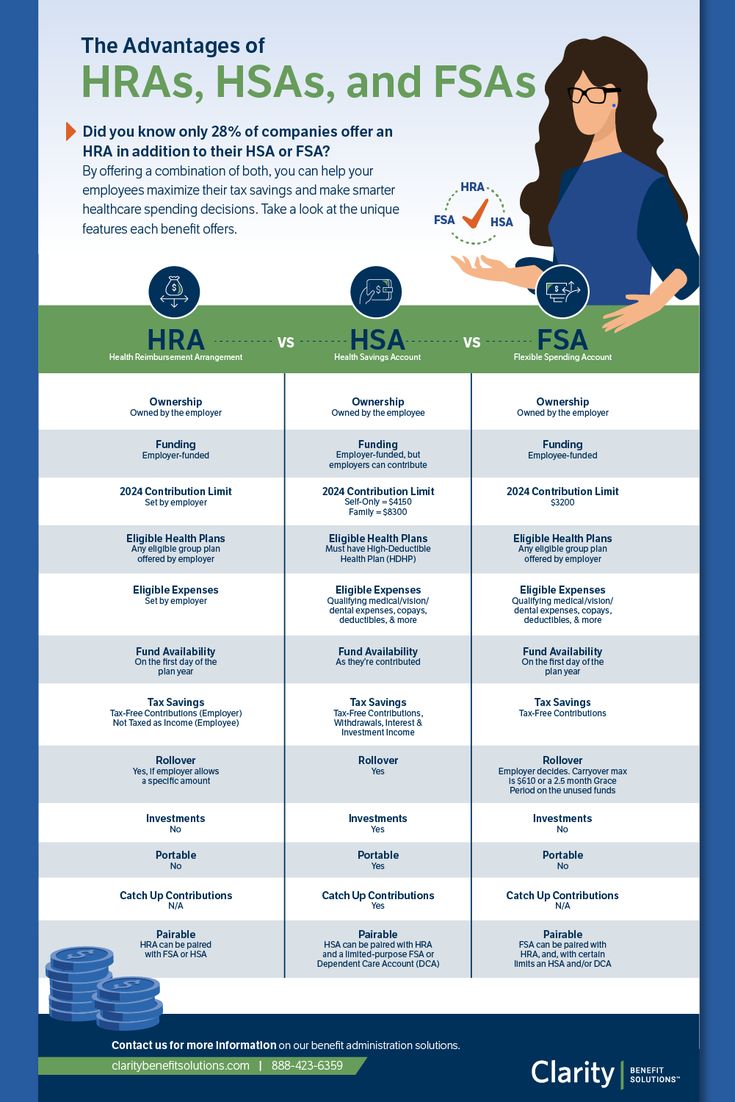

Difference Between Hsa And Fsa

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are both tax-advantaged accounts designed to help individuals and families save for qualified medical expenses. While they share a common goal, there are distinct differences between the two accounts in terms of eligibility, contribution limits, flexibility, and rollover options. Understanding these differences is crucial for individuals to make informed decisions about their healthcare savings and financial planning.

Understanding Health Savings Accounts (HSAs)

Health Savings Accounts are tax-exempt accounts established for individuals enrolled in a High Deductible Health Plan (HDHP). The primary purpose of an HSA is to allow individuals to save for future qualified medical expenses on a tax-free basis. Here’s a detailed look at the key aspects of HSAs:

Eligibility

To be eligible for an HSA, an individual must be covered by a High Deductible Health Plan (HDHP). HDHPs are health insurance plans with higher deductibles than traditional health plans, but they typically have lower premiums. Additionally, HSAs have income limits; individuals with modified adjusted gross income (MAGI) above a certain threshold may not be eligible to contribute to an HSA. The specific income limits vary based on filing status and are adjusted annually.

Contribution Limits

The Internal Revenue Service (IRS) sets annual contribution limits for HSAs. These limits are adjusted annually and are based on the individual’s coverage. For 2023, the maximum annual contribution limit for an individual with self-only coverage is 3,700, while those with family coverage can contribute up to 7,400. Individuals aged 55 and older can make additional catch-up contributions of $1,000.

Flexibility and Investment Options

HSAs offer significant flexibility and potential for growth. Funds contributed to an HSA can be invested in various financial instruments, including stocks, bonds, and mutual funds. This allows individuals to grow their savings over time, in addition to using the funds for qualified medical expenses. Moreover, HSAs have no “use-it-or-lose-it” rule; any funds not used in a given year remain in the account and can be carried over indefinitely.

Qualified Medical Expenses

HSAs can be used to pay for a wide range of qualified medical expenses, including doctor visits, prescription medications, dental care, vision care, and many other healthcare-related services and products. A comprehensive list of qualified medical expenses can be found on the IRS website. It’s important to note that HSA funds can also be used to pay for health insurance premiums if an individual becomes unemployed or otherwise loses their health coverage.

Exploring Flexible Spending Accounts (FSAs)

Flexible Spending Accounts, often referred to as FSAs, are another tax-advantaged account option for healthcare expenses. Unlike HSAs, FSAs are typically offered as an employee benefit and are not tied to a specific type of health insurance plan. FSAs offer a different set of features and benefits, which we’ll explore in detail below.

Eligibility and Employer-Sponsored FSAs

FSAs are often made available to employees as part of their benefits package. These accounts are usually sponsored by employers and are available to all eligible employees, regardless of their health insurance plan. Some employers may also offer limited-purpose FSAs, which can be used in conjunction with a High Deductible Health Plan (HDHP) and an HSA.

Contribution Limits and Flexibility

The contribution limits for FSAs are typically lower than those for HSAs. For 2023, the maximum annual contribution limit for a healthcare FSA is $2,900 for individuals and families. However, FSAs offer a significant advantage in that any funds contributed during the year can be used immediately, even if the funds haven’t been contributed yet. This “front-loading” feature can be beneficial for individuals with known, upcoming medical expenses.

Rollover and Grace Period

Unlike HSAs, FSAs generally operate on a “use-it-or-lose-it” basis. Any funds remaining in the account at the end of the plan year are typically forfeited. However, some FSAs offer a grace period of up to 2.5 months into the following year, during which employees can still use the remaining funds. Additionally, certain FSAs may allow for a limited rollover of up to $500 into the next year.

Qualified Medical Expenses

FSAs can be used to pay for a wide range of qualified medical expenses, similar to HSAs. This includes doctor visits, prescription medications, dental and vision care, and other healthcare services and products. It’s important to note that FSAs can also be used to pay for over-the-counter medications and other eligible expenses without a prescription, provided the FSA plan allows it.

Key Differences and Considerations

While HSAs and FSAs share the common goal of helping individuals save for qualified medical expenses, they differ significantly in terms of eligibility, contribution limits, flexibility, and rollover options. Here’s a comparison table highlighting some of the key differences:

| Aspect | Health Savings Accounts (HSAs) | Flexible Spending Accounts (FSAs) |

|---|---|---|

| Eligibility | Must be enrolled in a High Deductible Health Plan (HDHP) | Available to all eligible employees, regardless of health plan |

| Contribution Limits | Higher limits; $3,700 for self-only coverage and $7,400 for family coverage in 2023 | Lower limits; $2,900 for healthcare FSAs in 2023 |

| Flexibility | No "use-it-or-lose-it" rule; funds can be invested and carried over indefinitely | May have a "use-it-or-lose-it" rule; some plans offer a grace period or limited rollover |

| Rollover | Funds can be carried over indefinitely | Typically forfeited at the end of the plan year; some plans offer a grace period or limited rollover |

| Investment Options | Funds can be invested in various financial instruments | Funds are typically held in cash or cash equivalents |

When deciding between an HSA and an FSA, individuals should consider their current and future healthcare needs, their income and tax situation, and their preference for flexibility and investment options. HSAs may be more suitable for individuals with higher medical expenses or those who want the option to invest their savings. FSAs, on the other hand, can be a good option for individuals with known, upcoming medical expenses or those who want a simpler, more immediate use of their funds.

Maximizing the Benefits of HSAs and FSAs

Both HSAs and FSAs offer significant tax advantages and can help individuals save for qualified medical expenses. To maximize the benefits of these accounts, individuals should consider the following strategies:

- Contribute the maximum amount allowed each year, especially if you anticipate significant medical expenses.

- Use the funds for qualified medical expenses whenever possible to take full advantage of the tax benefits.

- If you have an HSA, consider investing a portion of your contributions to potentially grow your savings over time.

- Keep track of your medical expenses and receipts to ensure you can accurately report and claim your expenses.

- Review your account regularly to ensure you're on track with your savings goals and to make any necessary adjustments.

By understanding the differences between HSAs and FSAs and utilizing these accounts effectively, individuals can take control of their healthcare expenses and make the most of their financial resources.

Can I have both an HSA and an FSA at the same time?

+In most cases, you cannot have both an HSA and an FSA simultaneously. If you’re enrolled in a High Deductible Health Plan (HDHP) and have an HSA, you’re generally not eligible for an FSA. However, there are some limited-purpose FSAs that can be used in conjunction with an HDHP and an HSA.

What happens if I switch from an HDHP to a traditional health plan? Can I still contribute to my HSA?

+If you switch from an HDHP to a traditional health plan, you may no longer be eligible to contribute to your HSA. However, you can continue to use the funds in your HSA for qualified medical expenses. It’s important to review the specific rules and regulations for your HSA provider in such cases.

Are there any penalties for withdrawing funds from an HSA or FSA for non-qualified expenses?

+Withdrawing funds from an HSA or FSA for non-qualified expenses can result in penalties and taxes. HSAs are subject to a 20% penalty tax on the distribution, in addition to regular income tax. FSAs typically have a “use-it-or-lose-it” rule, and any funds not used by the end of the plan year or grace period are forfeited.