Master Promissory Note

The Master Promissory Note (MPN) is a legally binding document that plays a crucial role in the world of student loans and financial aid. It is an agreement between a borrower and a lending institution, typically the U.S. Department of Education, where the borrower promises to repay the loan, along with any accrued interest and fees, according to the terms outlined in the note.

With the rising cost of higher education, an increasing number of students are turning to student loans to fund their education. The MPN simplifies the process by allowing borrowers to consolidate multiple loans into one agreement, making it easier to manage their repayment obligations. In this comprehensive guide, we will delve into the intricacies of the Master Promissory Note, exploring its purpose, key provisions, and its impact on borrowers and the student loan industry.

Understanding the Master Promissory Note

The Master Promissory Note serves as a comprehensive contract that outlines the borrower's responsibilities and the lender's rights regarding the repayment of student loans. It is a vital document that ensures both parties understand the terms and conditions of the loan agreement. The MPN covers various types of federal student loans, including Direct Subsidized Loans, Direct Unsubsidized Loans, and Direct PLUS Loans.

When a borrower signs an MPN, they are agreeing to the following key provisions:

- Repayment Terms: The MPN specifies the repayment period, typically 10 years, and the borrower's obligation to make regular payments towards the loan principal and interest. It also outlines the consequences of defaulting on the loan, including late fees, collection costs, and potential legal action.

- Interest Rates: The note provides information on the interest rates applicable to the loan. Federal student loans often have fixed interest rates, which are set by Congress and remain constant throughout the life of the loan.

- Loan Limits: The MPN outlines the maximum loan amounts a borrower can receive each academic year, based on their year in school and dependency status. These limits are designed to prevent excessive borrowing and ensure that students have a manageable debt load upon graduation.

- Grace Period: The MPN explains the grace period, which is a period of time after a borrower leaves school or drops below half-time enrollment before they must begin repaying their loans. This grace period allows borrowers to establish themselves financially before starting their repayment journey.

- Deferment and Forbearance: The note details the options available to borrowers who may face financial hardship and need temporary relief from their repayment obligations. Deferment and forbearance allow borrowers to postpone or reduce their payments under certain circumstances.

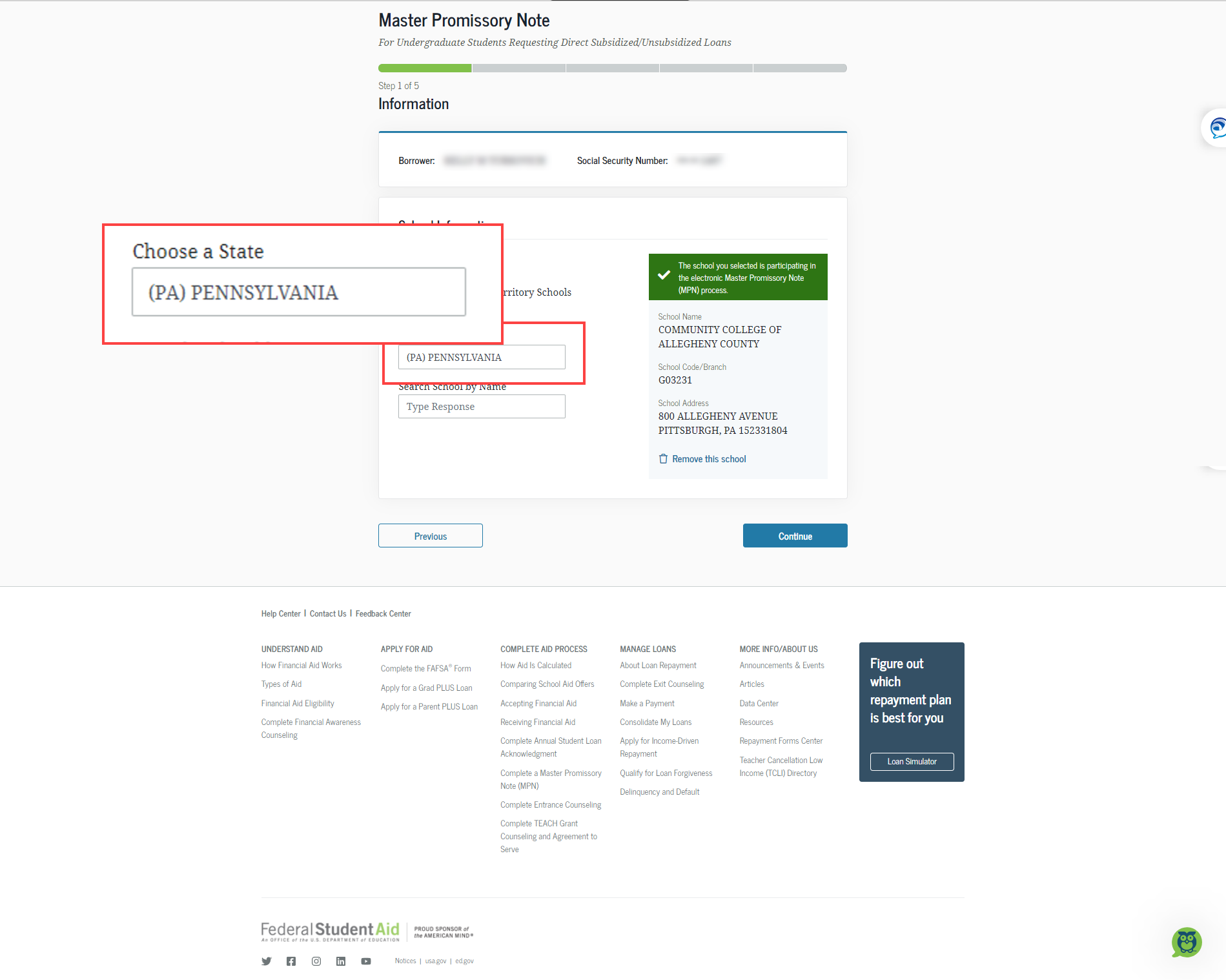

The Process of Signing an MPN

Signing a Master Promissory Note is a straightforward process, but it requires careful consideration and understanding of the terms involved. Here's a step-by-step guide to signing an MPN:

- Eligibility Check: Before applying for a federal student loan, borrowers should ensure they meet the eligibility criteria. This includes being a U.S. citizen or eligible non-citizen, being enrolled at least half-time in an eligible degree or certificate program, and maintaining satisfactory academic progress.

- Complete the FAFSA: The Free Application for Federal Student Aid (FAFSA) is a crucial step in the financial aid process. It helps determine a borrower's eligibility for federal student loans and other forms of financial aid. Completing the FAFSA accurately and on time is essential to access the funds needed for education.

- Accept the Loan Offer: Once a borrower's financial aid package is finalized, they will receive an award letter outlining their loan offer. It is important to carefully review the terms and conditions of the loan, including the interest rate, fees, and repayment options, before accepting the offer.

- Complete Loan Counseling: Before signing the MPN, borrowers are typically required to complete loan counseling. This counseling session provides valuable information about the responsibilities and obligations associated with taking out a student loan. It helps borrowers understand the impact of borrowing and the importance of responsible repayment.

- Sign the MPN: After completing the necessary steps, borrowers can sign the Master Promissory Note either online or on paper. The online process is often more convenient and allows borrowers to track the status of their loan application. The MPN must be signed by both the borrower and a witness, who can be a school official or a designated representative.

- Submit Additional Documentation (if required): In some cases, lenders may require additional documentation to verify a borrower's identity or eligibility. This could include providing a copy of a driver's license, social security card, or other identification documents. It is important to submit these documents promptly to avoid delays in loan processing.

- Loan Disbursement: Once the MPN is signed and all required documentation is submitted, the lender will disburse the loan funds to the borrower's school. The funds are typically applied directly to the borrower's tuition, fees, and other educational expenses. Any remaining funds are then disbursed to the borrower for their personal use.

Benefits and Considerations of the MPN

The Master Promissory Note offers several benefits to borrowers and the student loan industry as a whole:

- Simplified Loan Process: The MPN streamlines the loan application process by allowing borrowers to consolidate multiple loans into one agreement. This reduces paperwork and makes it easier for borrowers to manage their repayment obligations.

- Flexibility: The MPN provides borrowers with flexibility in choosing their repayment plan. Borrowers can select from various repayment options, such as standard repayment, income-driven repayment plans, or extended repayment plans, based on their financial circumstances and preferences.

- Forgiveness and Discharge: The MPN outlines the conditions under which a borrower may be eligible for loan forgiveness or discharge. This includes options such as Public Service Loan Forgiveness, Teacher Loan Forgiveness, and Total and Permanent Disability discharge. Understanding these provisions can help borrowers plan for their future and manage their debt strategically.

- Grace Period and Deferment: The grace period and deferment options provided by the MPN offer borrowers a period of financial relief after leaving school. This allows borrowers to focus on establishing their careers and financial stability before starting their repayment journey.

However, it is important to consider the following when dealing with the MPN:

- Borrower Responsibility: While the MPN provides a comprehensive agreement, it is ultimately the borrower's responsibility to understand and adhere to the terms of the loan. Borrowers should carefully review the note, ask questions, and seek clarification if needed to ensure they fully comprehend their obligations.

- Default Consequences: Defaulting on a student loan can have severe consequences, including wage garnishment, tax refund interception, and damage to the borrower's credit score. The MPN outlines these consequences, emphasizing the importance of timely repayment and responsible borrowing.

- Repayment Options: Borrowers should carefully consider their repayment options and choose a plan that aligns with their financial goals and circumstances. Repayment plans with lower monthly payments may result in higher overall interest costs, so borrowers should weigh the pros and cons before making a decision.

The Impact of the MPN on Student Loan Borrowers

The Master Promissory Note has a significant impact on student loan borrowers, shaping their financial journey and future. Here's how the MPN affects borrowers:

Financial Planning and Management

The MPN serves as a financial roadmap for borrowers, outlining their repayment obligations and providing a clear understanding of their loan terms. By signing the MPN, borrowers commit to a long-term financial obligation, which requires careful planning and management. It encourages borrowers to develop a budget, track their spending, and make informed decisions about their finances.

Repayment Strategies

The MPN offers borrowers a range of repayment strategies to choose from. Borrowers can opt for standard repayment, which has fixed monthly payments over a 10-year period, or explore income-driven repayment plans, which base monthly payments on a percentage of the borrower's discretionary income. The MPN empowers borrowers to select a repayment plan that aligns with their financial situation and helps them avoid default.

Default Prevention

The MPN plays a crucial role in preventing student loan default. By outlining the consequences of default, the MPN serves as a reminder to borrowers of the importance of timely repayment. It encourages borrowers to stay informed about their repayment options, seek assistance when needed, and take advantage of deferment or forbearance options during periods of financial hardship.

Loan Forgiveness and Discharge

The MPN provides borrowers with information on loan forgiveness and discharge options. For borrowers pursuing careers in public service or teaching, the MPN highlights the Public Service Loan Forgiveness and Teacher Loan Forgiveness programs. Additionally, the MPN outlines the conditions for Total and Permanent Disability discharge, offering relief to borrowers who become permanently disabled.

The Role of the MPN in the Student Loan Industry

The Master Promissory Note is a cornerstone of the student loan industry, providing a standardized agreement that benefits both borrowers and lenders. Here's how the MPN contributes to the industry:

Lender Protection

The MPN offers lenders protection by outlining the borrower's commitment to repay the loan. It ensures that borrowers understand their repayment obligations and provides lenders with legal recourse in the event of default. By having a standardized agreement, lenders can manage their risk effectively and extend loans to a wider range of borrowers.

Streamlined Loan Processing

The MPN simplifies the loan processing and disbursement process. With a single agreement, lenders can efficiently manage multiple loans for a borrower, reducing administrative burdens and streamlining the overall process. This efficiency benefits both borrowers and lenders, leading to a more efficient and timely disbursement of funds.

Borrower Education

The MPN serves as an educational tool for borrowers, providing them with a comprehensive understanding of their loan terms and repayment obligations. By requiring borrowers to complete loan counseling and sign the MPN, lenders ensure that borrowers are well-informed and prepared for their financial journey. This education empowers borrowers to make responsible borrowing and repayment decisions.

Data Management and Analysis

The MPN generates valuable data that can be analyzed to improve the student loan industry. Lenders and government agencies can use MPN data to identify trends, assess borrower behavior, and develop strategies to enhance loan repayment rates. This data-driven approach allows for continuous improvement and better support for borrowers throughout their repayment journey.

The Future of the Master Promissory Note

As the student loan landscape continues to evolve, the Master Promissory Note is likely to undergo changes and adaptations to meet the needs of borrowers and the industry. Here are some potential future developments:

Digital Transformation

The MPN is already available in digital format, but further digital transformation is expected. Lenders may explore more user-friendly and secure online platforms for borrowers to sign and manage their MPNs. This shift towards digital MPNs can enhance convenience, accessibility, and security for borrowers and lenders alike.

Enhanced Borrower Education

To empower borrowers and promote responsible borrowing, there may be a focus on enhancing the educational component of the MPN. Lenders and government agencies could collaborate to develop more comprehensive loan counseling programs, providing borrowers with a deeper understanding of their loan terms, repayment options, and the potential long-term impact of their borrowing decisions.

Income-Driven Repayment Plans

Income-driven repayment plans have gained popularity in recent years, and their integration into the MPN is likely to continue. Lenders may explore ways to streamline the application process for income-driven repayment plans, making it easier for borrowers to access these plans and manage their repayment obligations based on their financial circumstances.

Loan Servicing Improvements

The MPN can serve as a foundation for improving loan servicing and borrower support. Lenders may invest in technologies and resources to enhance communication with borrowers, provide timely updates on loan status, and offer personalized repayment strategies. By improving loan servicing, lenders can better support borrowers throughout their repayment journey.

Frequently Asked Questions

What happens if I default on my student loan?

+Defaulting on a student loan can have serious consequences. It may result in wage garnishment, tax refund interception, and damage to your credit score. It is important to explore options such as loan rehabilitation or consolidation to get back on track with your repayment obligations.

Can I consolidate my federal student loans with private loans?

+No, federal student loans and private loans are separate entities and cannot be consolidated together. Federal student loans can be consolidated through the Direct Consolidation Loan program, while private loans typically require separate consolidation or refinancing options.

How long does it take to repay a student loan?

+The repayment period for a student loan depends on the loan type and repayment plan chosen. The standard repayment plan for federal student loans has a 10-year repayment period. However, income-driven repayment plans and extended repayment plans can offer longer repayment terms, up to 25 years or more.

The Master Promissory Note is a vital component of the student loan process, providing a legally binding agreement between borrowers and lenders. By understanding the terms and provisions of the MPN, borrowers can make informed decisions about their financial future. As the student loan industry continues to evolve, the MPN will likely adapt to meet the changing needs of borrowers and ensure a sustainable and responsible borrowing environment.