Tuition Bill Tips: Strategies For Affordable Education

In today's world, education is a powerful tool for personal growth and career advancement. However, the rising costs of tuition can be a significant barrier for many aspiring students. The financial burden of education often leads to difficult decisions and sacrifices. In this comprehensive guide, we will explore effective strategies to make education more affordable and accessible, empowering individuals to pursue their academic dreams without breaking the bank.

Understanding the Tuition Landscape

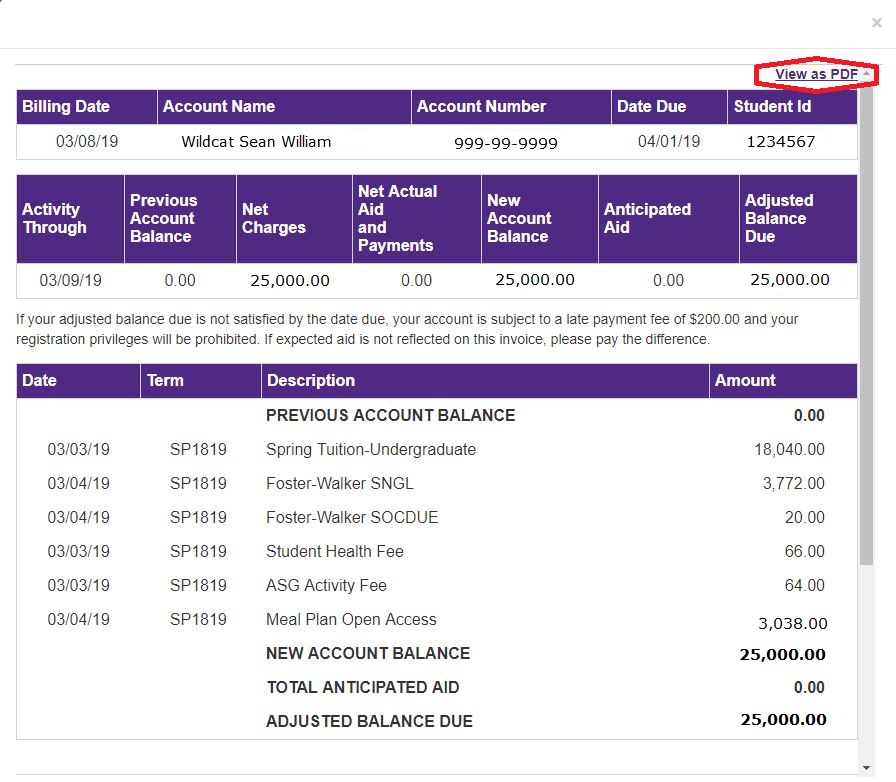

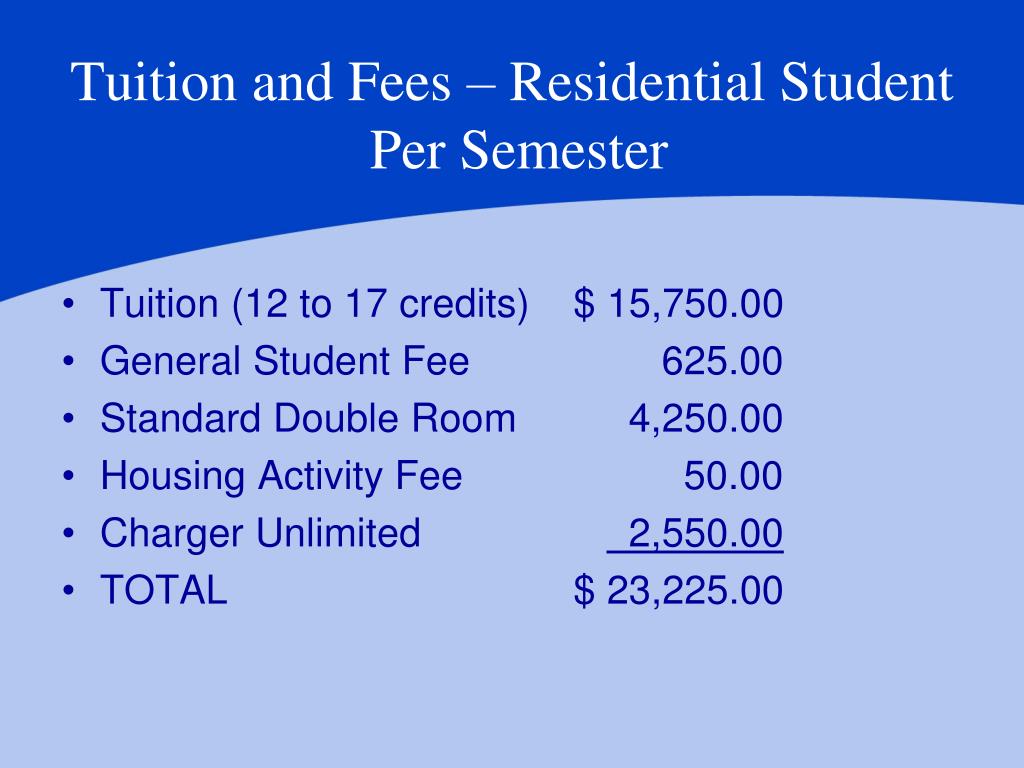

Before diving into the strategies, it’s essential to grasp the current state of tuition fees. The cost of education has been on a steady rise, with tuition bills often reaching tens of thousands of dollars annually. This trend affects students from all backgrounds, making it crucial to explore cost-effective options.

The Impact of Tuition Increases

Rising tuition fees have far-reaching consequences. They can limit access to quality education, especially for students from low-income families. Additionally, the debt burden associated with high tuition costs can impact students’ financial stability for years after graduation.

According to recent statistics, the average student loan debt in the United States is over $30,000. This figure highlights the financial strain that many graduates face, often leading to delayed life milestones such as buying a home or starting a family.

| Education Level | Average Tuition Increase (%) |

|---|---|

| Undergraduate | 5-10% |

| Graduate | 8-12% |

| Professional Programs | 10-15% |

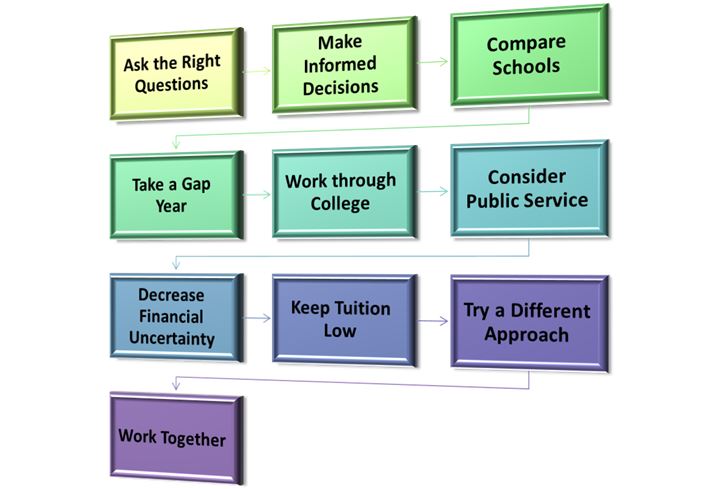

Exploring Affordable Education Options

The good news is that there are numerous strategies and resources available to make education more affordable. By combining these strategies, students can significantly reduce their tuition costs and manage their finances effectively.

Scholarships and Grants

Scholarships and grants are financial awards that do not require repayment. These can be based on academic merit, financial need, or specific criteria set by the scholarship provider. Students should thoroughly research and apply for scholarships that align with their backgrounds and interests.

For instance, many universities offer scholarships for academic excellence, while others focus on supporting students from underrepresented communities. Additionally, external organizations, corporations, and foundations often provide scholarships to promote specific fields of study or social causes.

Financial Aid and Loans

Financial aid packages often include a combination of grants, scholarships, work-study opportunities, and loans. Students should complete the necessary paperwork, such as the Free Application for Federal Student Aid (FAFSA) in the United States, to access these financial aid options.

While loans can be a valuable resource, it's crucial to borrow responsibly. Students should only take out loans that they can reasonably afford to repay after graduation. Exploring federal loan options, which often have lower interest rates and more flexible repayment plans, can be a wise choice.

Work-Study Programs

Work-study programs allow students to earn money while gaining valuable work experience. These programs often provide part-time jobs on or near the campus, allowing students to balance their studies and income generation.

The benefits of work-study programs extend beyond financial support. Students can develop valuable skills, network with professionals, and gain insights into their chosen field, enhancing their overall educational experience.

Community Colleges and Online Learning

Community colleges offer an affordable alternative to traditional four-year universities. They often have lower tuition fees and provide a solid foundation for further education. Students can complete their general education requirements at a community college and then transfer to a four-year institution to complete their degree.

Online learning has also revolutionized the education landscape, making it more accessible and affordable. Many reputable institutions now offer online degree programs, allowing students to learn from anywhere in the world. Online courses often have lower fees and flexible schedules, making them an attractive option for working professionals or those with busy schedules.

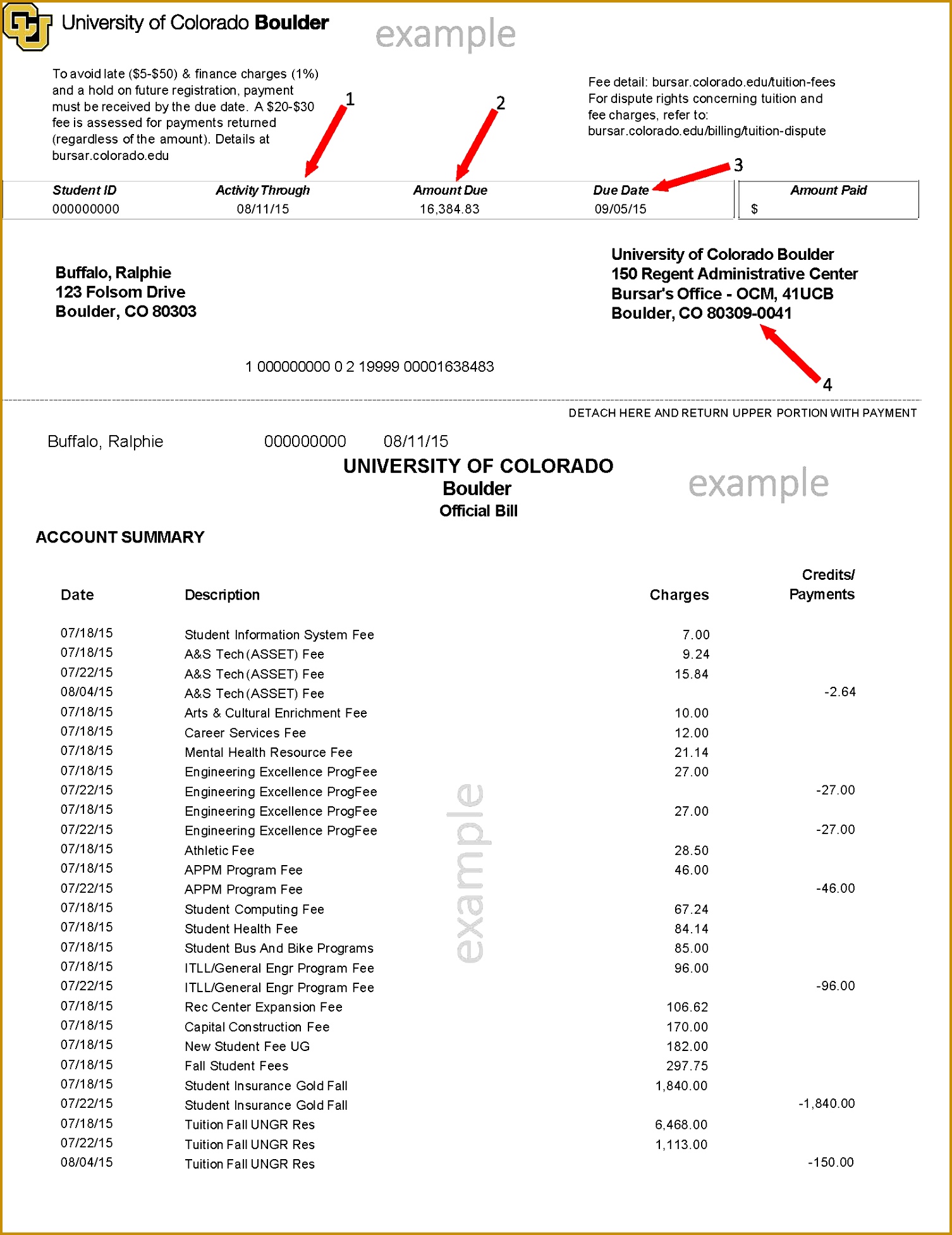

Tuition Payment Plans

Many educational institutions offer tuition payment plans, allowing students to spread out their tuition costs over multiple installments. This can alleviate the financial burden of paying the entire tuition fee upfront. Students should inquire about these plans and explore the payment options available to them.

Some institutions even provide interest-free payment plans, making it easier for students to manage their finances without incurring additional debt.

Negotiating Tuition Fees

In certain cases, students can negotiate their tuition fees, especially if they are high-achieving or have unique skills. Institutions may be willing to offer scholarships or discounts to attract talented individuals. Students should research the institution’s policies and approach the financial aid office with a well-prepared case for why they deserve a reduced tuition fee.

Maximizing Financial Resources

In addition to exploring affordable education options, students can take steps to maximize their financial resources and reduce expenses.

Budgeting and Financial Planning

Creating a budget and sticking to it is essential for managing finances effectively. Students should track their income and expenses, allocate funds for tuition and other educational costs, and make informed decisions about their spending.

Financial planning apps and tools can be valuable resources for budgeting. These tools help students visualize their financial situation, set goals, and make adjustments to stay on track.

Reducing Living Expenses

Living expenses can quickly add up, especially for students living off-campus. By adopting a frugal lifestyle and making conscious choices, students can reduce their living costs significantly.

Sharing accommodations, cooking at home, and opting for public transportation or biking instead of owning a car are some strategies to cut down on living expenses. Additionally, students can explore part-time jobs or freelance work to supplement their income and offset these costs.

Utilizing Campus Resources

Campuses often offer a wealth of resources and services that can help students save money. From free tutoring and academic support to discounted software and printing services, students should take advantage of these offerings.

Additionally, many campuses have partnerships with local businesses, offering students discounts on dining, entertainment, and other services. Exploring these partnerships can lead to significant savings throughout a student's academic journey.

The Long-Term Benefits of Affordable Education

Investing in affordable education strategies not only benefits students financially but also has long-term positive impacts on their lives and careers.

Reduced Student Loan Debt

By minimizing tuition costs and managing finances effectively, students can graduate with significantly less student loan debt. This financial freedom allows graduates to pursue their career goals without the burden of overwhelming debt.

According to a recent study, individuals with high student loan debt often face challenges in saving for emergencies, investing in their future, and even starting a family. By prioritizing affordable education, students can avoid these financial pitfalls and enjoy a more stable and secure future.

Enhanced Career Opportunities

Affordable education strategies can open doors to a wider range of career opportunities. With reduced financial stress, students can explore internships, research opportunities, and extracurricular activities that enhance their resumes and skill sets.

Additionally, graduates with lower student loan debt are more likely to pursue further education or entrepreneurship. They can invest in their professional development, attend conferences, and network with industry professionals, all of which can lead to exciting career prospects.

Positive Impact on Society

Affordable education has a ripple effect on society as a whole. When more individuals have access to quality education, it leads to a more skilled and knowledgeable workforce. This, in turn, drives innovation, economic growth, and social progress.

Furthermore, affordable education promotes social mobility, allowing individuals from diverse backgrounds to pursue their dreams and contribute to their communities. It breaks down barriers and creates a more equitable society, where education is a right, not a privilege.

Conclusion: Empowering the Next Generation

Education is a powerful catalyst for personal and societal transformation. By adopting affordable education strategies, students can pursue their academic goals without compromising their financial well-being. From scholarships and grants to budgeting and campus resources, there are numerous ways to make education more accessible and affordable.

As we've explored in this guide, the benefits of affordable education extend far beyond the classroom. It empowers individuals to reach their full potential, pursue their passions, and contribute to a brighter future for all. By making education more accessible, we can build a more educated, skilled, and equitable society, where every individual has the opportunity to thrive.

What are some common scholarship opportunities for students?

+There are various scholarship opportunities available, including academic scholarships, athletic scholarships, need-based scholarships, and scholarships for specific fields of study. Students should research and apply for scholarships that align with their interests and qualifications.

How can I find affordable online degree programs?

+Students can explore online degree programs offered by reputable universities and colleges. Many institutions now provide affordable online options with flexible schedules. It’s essential to research the accreditation and reputation of the institution before enrolling.

Are there any tax benefits for students pursuing higher education?

+Yes, in many countries, there are tax benefits and credits available for students pursuing higher education. These benefits can help offset the cost of tuition and related expenses. Students should consult a tax professional or research the specific tax laws in their country to understand the available options.