University Of Texas Costs: Unveiling Financial Aid Opportunities

The University of Texas (UT) is renowned for its academic excellence and diverse range of programs, attracting students from across the globe. However, the cost of tuition and living expenses can be a significant concern for prospective students and their families. In this comprehensive guide, we will delve into the financial aid opportunities available at UT, providing a detailed breakdown of the various options and insights into how to navigate the financial aid process successfully.

Understanding the Cost of Attendance at UT

Before we explore the financial aid landscape, it's essential to understand the overall cost of attendance at the University of Texas. The expenses can vary depending on various factors, including residency status, program of study, and living arrangements.

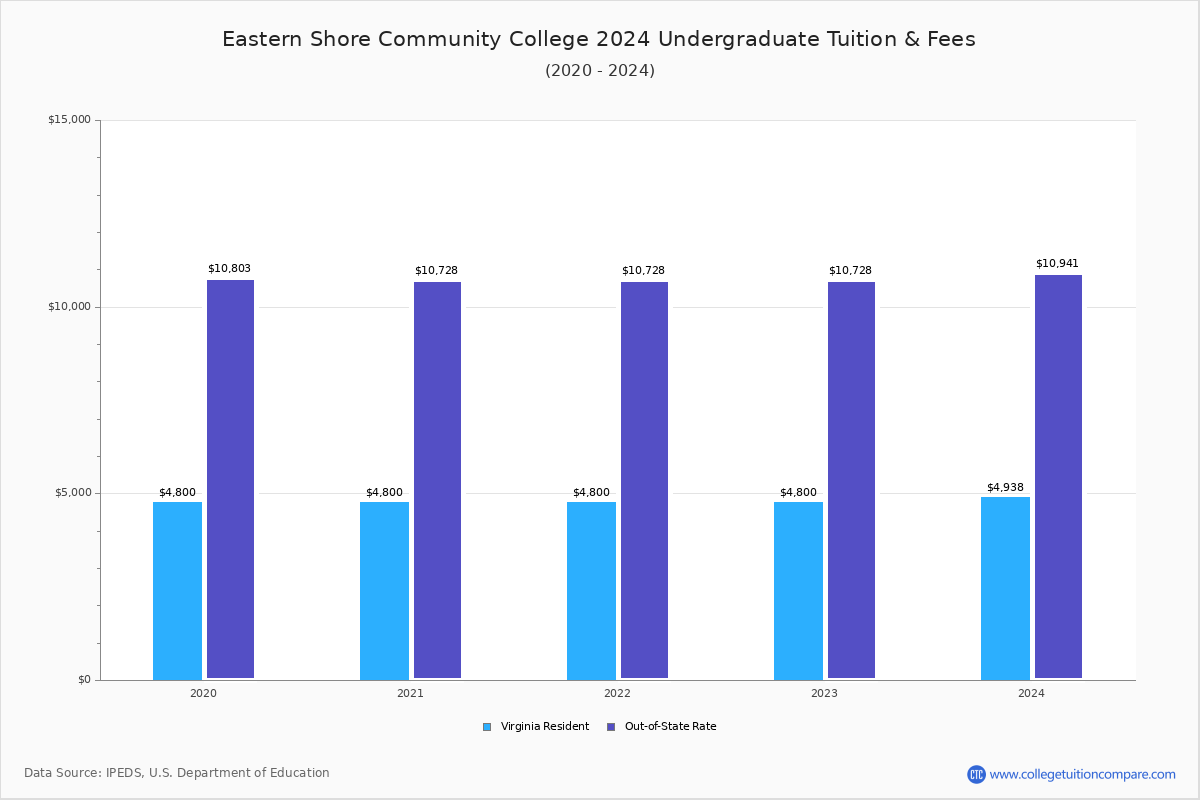

Tuition and Fees

Tuition fees at UT are determined by the student's residency status and the program they are enrolled in. Out-of-state students typically pay higher tuition rates compared to in-state residents. The average annual tuition for undergraduate programs ranges from $10,000 to $15,000 for in-state students and can be significantly higher for out-of-state students.

For graduate programs, tuition fees can vary widely depending on the field of study. For instance, professional programs like law or medicine may have higher tuition costs, while other graduate programs may be more affordable.

| Student Category | Average Annual Tuition |

|---|---|

| In-State Undergraduate | $12,000 |

| Out-of-State Undergraduate | $30,000 |

| Graduate Students (varies by program) | $15,000 - $40,000 |

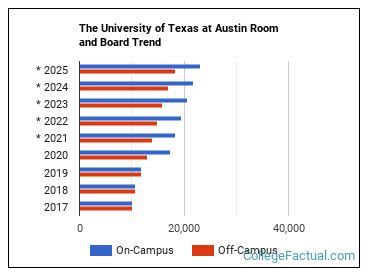

Living Expenses

In addition to tuition, students must consider living expenses, which can include accommodation, meals, transportation, and other daily costs. The cost of living can vary depending on whether a student chooses on-campus housing or off-campus accommodation. On-campus housing tends to be more expensive but offers the convenience of being close to campus.

Off-campus housing can be more affordable, but students need to factor in additional costs such as utilities, internet, and transportation. The average cost of living for a student in Austin, Texas, is estimated to be around $1,200 to $1,500 per month, including accommodation, food, and other essentials.

Financial Aid at the University of Texas

Financial aid is a crucial component of making a UT education accessible to students from diverse backgrounds. The university offers a range of financial assistance programs, including scholarships, grants, work-study opportunities, and loans. Let's explore these options in detail.

Scholarships

Scholarships are a popular form of financial aid, often awarded based on academic merit, leadership potential, or specific talents. The University of Texas provides numerous scholarship opportunities, both from the university itself and external organizations.

- UT Excellence Scholarships: These highly competitive scholarships are awarded to exceptional incoming freshmen based on academic achievement and leadership potential. The scholarships cover full tuition and provide additional benefits such as study abroad opportunities.

- Departmental Scholarships: Many academic departments at UT offer scholarships to outstanding students majoring in their respective fields. These scholarships may have specific eligibility criteria and vary in value.

- External Scholarships: Students can also explore external scholarships offered by private organizations, foundations, and community groups. These scholarships often have unique themes or requirements and can significantly reduce the financial burden of tuition.

Grants

Grants are another form of financial aid that students do not need to repay. They are typically need-based and are awarded based on the student's financial circumstances. The University of Texas offers various grant programs to support students with demonstrated financial need.

- Federal Pell Grants: These grants are available to undergraduate students with exceptional financial need. The amount awarded depends on factors such as the student's expected family contribution, the cost of attendance, and their enrollment status.

- UT Need-Based Grants: The university provides need-based grants to eligible students to help cover their tuition and living expenses. These grants are awarded based on the Free Application for Federal Student Aid (FAFSA) and other financial information provided by the student.

- State-Funded Grants: In addition to federal and institutional grants, students may also be eligible for state-funded grants. These grants are often awarded based on residency and financial need. Students should check with their state's higher education agency for more information.

Work-Study Programs

The Federal Work-Study program provides part-time employment opportunities for students with financial need. Through this program, students can work on campus or with approved off-campus employers to earn money to help cover their educational expenses.

- Students can find work-study jobs in various departments on campus, including libraries, research labs, and administrative offices. These jobs offer flexible hours to accommodate students' academic schedules.

- The earnings from work-study jobs can be used to pay for tuition, books, and living expenses, providing students with valuable work experience and financial support.

Loans

Loans are a common form of financial aid, but they must be repaid with interest. The University of Texas offers various loan programs to assist students in financing their education.

- Federal Student Loans: The most common type of loan for students is the Federal Direct Loan Program. These loans offer fixed interest rates and flexible repayment options. Students can choose from subsidized loans, where the government covers the interest while the student is in school, or unsubsidized loans, where interest accrues from the time of disbursement.

- Private Loans: In addition to federal loans, students may also consider private loans from banks or other financial institutions. Private loans often have higher interest rates and may require a credit check or a co-signer. Students should carefully consider the terms and conditions of private loans before borrowing.

Navigating the Financial Aid Process

Applying for financial aid at the University of Texas involves a series of steps to ensure a smooth and successful process. Here's a step-by-step guide to help students navigate the financial aid journey.

Step 1: Complete the FAFSA

The Free Application for Federal Student Aid (FAFSA) is the first step in accessing most forms of financial aid, including federal grants, work-study, and loans. Students should complete the FAFSA as soon as possible after October 1st of the year prior to their enrollment.

- The FAFSA collects information about the student's financial circumstances, including income, assets, and family size. This information is used to determine the student's Expected Family Contribution (EFC), which is a key factor in assessing financial need.

- Students can complete the FAFSA online at https://fafsa.ed.gov. It is essential to provide accurate and complete information to avoid delays in processing.

Step 2: Explore UT-Specific Financial Aid

In addition to federal aid, students should investigate the financial aid opportunities available specifically at the University of Texas. The university's financial aid office provides comprehensive resources and guidance to help students navigate the process.

- Students can explore the various scholarships, grants, and work-study programs offered by UT by visiting the financial aid website. The website often includes information about eligibility criteria, application deadlines, and how to apply.

- It is crucial to meet all application deadlines to maximize the chances of receiving financial aid. Students should carefully review the requirements and submit all necessary documentation on time.

Step 3: Consider External Scholarships

Students should also explore external scholarship opportunities to supplement their financial aid package. These scholarships can be found through various sources, including community organizations, professional associations, and online scholarship databases.

- Students should research and apply for scholarships that align with their interests, academic achievements, or unique talents. Many external scholarships have specific eligibility criteria, so it's essential to read the guidelines carefully.

- Students can also consult with their high school counselors, college advisors, or career centers for guidance on finding and applying for external scholarships.

Step 4: Compare and Choose Aid Options

Once students have received their financial aid offers, it's essential to carefully review and compare the options. They should consider the total cost of attendance, the amount of aid offered, and the terms and conditions of each award.

- Students should prioritize grants and scholarships, as these forms of aid do not need to be repaid. Work-study programs can also be a great option, as they provide an opportunity to earn money while gaining valuable work experience.

- Loans should be considered as a last resort, as they accumulate interest and can create a significant financial burden after graduation. Students should borrow only what they absolutely need and explore repayment options to ensure they can manage their loan debt effectively.

Maximizing Financial Aid Opportunities

To make the most of financial aid opportunities at the University of Texas, students can employ various strategies to increase their chances of receiving aid and reducing their overall costs.

Early Application and Deadlines

Applying for financial aid early is crucial. Students should aim to complete the FAFSA as soon as it becomes available on October 1st. Early application increases the likelihood of receiving aid and ensures that students meet all relevant deadlines.

Maintaining Academic Excellence

Many scholarships and grants are awarded based on academic merit. Students can improve their chances of receiving these awards by maintaining a strong academic record. Good grades demonstrate a student's dedication and potential, making them more attractive to scholarship committees.

Exploring Merit-Based Scholarships

In addition to need-based aid, students should explore merit-based scholarships. These scholarships are often awarded for academic achievement, leadership, or specific talents. Students can search for merit-based scholarships through the university's financial aid office or online scholarship databases.

Utilizing Campus Resources

The University of Texas offers various resources to support students' financial well-being. Students should take advantage of these resources, such as financial literacy workshops, budgeting tools, and one-on-one counseling sessions with financial aid advisors.

Seeking External Support

Students can also seek support from external organizations and community groups. Many non-profit organizations and foundations offer scholarships or grants to students in need. Students can research and apply for these opportunities to supplement their financial aid package.

Frequently Asked Questions

How do I know if I'm eligible for financial aid at UT?

+Eligibility for financial aid at UT is determined by various factors, including financial need, academic merit, and residency status. The Free Application for Federal Student Aid (FAFSA) is the primary tool used to assess financial need. Additionally, students should explore the university's scholarship and grant opportunities, which may have specific eligibility criteria.

What is the average financial aid package for a UT student?

+The average financial aid package for a UT student can vary widely depending on their financial need, academic achievements, and other factors. On average, students receive a combination of grants, scholarships, work-study, and loans to help cover their tuition and living expenses. It's best to consult with the financial aid office for a personalized estimate.

Can I appeal a financial aid decision if I think it's incorrect or unfair?

+Yes, students have the right to appeal a financial aid decision if they believe there has been an error or if their circumstances have changed significantly since submitting the FAFSA. Students should contact the financial aid office to discuss their situation and provide additional documentation to support their appeal.

Financial aid is a vital aspect of making a University of Texas education accessible to a diverse range of students. By understanding the cost of attendance, exploring the various financial aid options, and navigating the application process effectively, students can reduce their financial burden and focus on their academic pursuits. With careful planning and a proactive approach, students can maximize their financial aid opportunities and make their UT experience more affordable and rewarding.