Unveiling The 2025 Limits: A Comprehensive Guide To Dependent Care Fsas

In the realm of financial planning and healthcare, understanding the intricacies of Flexible Spending Accounts (FSAs) is paramount. Among the various types of FSAs, Dependent Care FSAs (DCFSA) stand out for their unique focus on supporting working families with dependent care expenses. As we approach 2025, it's essential to delve into the evolving landscape of DCFSAs, exploring their limits, benefits, and the strategies that can maximize their potential.

The Evolution of Dependent Care FSAs: A Historical Perspective

Dependent Care FSAs have a rich history, dating back to the 1980s when they were introduced as a means to provide tax-advantaged funding for childcare expenses. Over the years, these FSAs have undergone significant transformations, adapting to the changing needs of American families and the evolving tax landscape.

Initially, DCFSAs were designed to assist working parents with the costs of childcare, including day care centers, nannies, and after-school programs. The early 2000s saw an expansion of these accounts, allowing for the coverage of elder care expenses for dependent parents or grandparents. This evolution reflected the diverse needs of families and the growing importance of caregiving in the modern workforce.

As we look ahead to 2025, it's crucial to recognize the continued relevance of DCFSAs. With a growing focus on work-life balance and the increasing cost of caregiving, these accounts offer a crucial financial tool for many households. In this comprehensive guide, we'll explore the current limits, benefits, and strategies associated with DCFSAs, offering a roadmap for individuals and families to navigate these accounts effectively.

Understanding the 2025 Limits: A Deep Dive into DCFSA Contributions

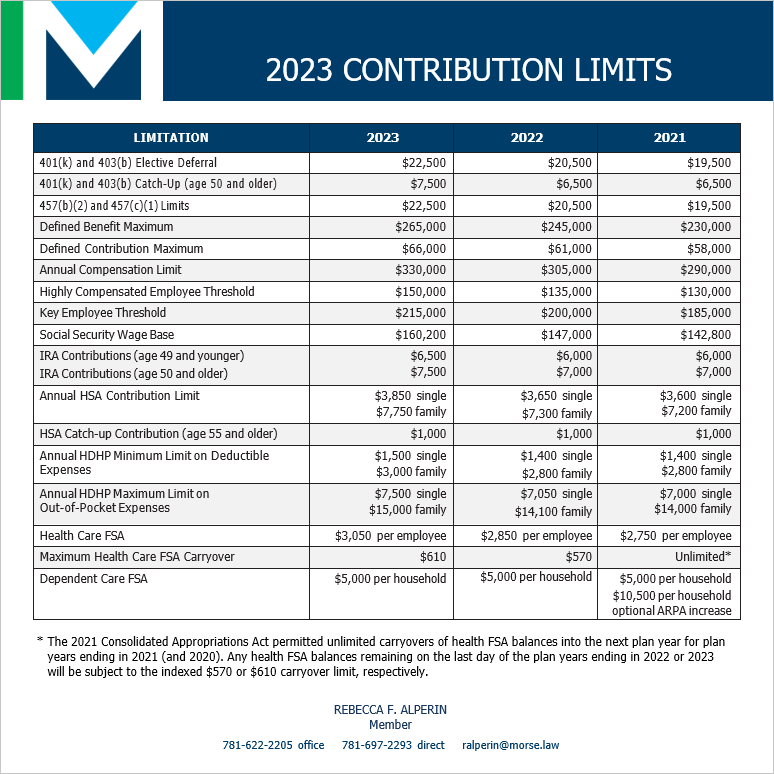

One of the most critical aspects of managing a DCFSA is understanding the contribution limits. For the year 2025, the Internal Revenue Service (IRS) has set the annual contribution limit for DCFSAs at 5,000 per individual or 10,000 for married couples filing jointly. These limits are designed to provide sufficient coverage for a wide range of dependent care expenses while also ensuring the financial health of the account.

It's important to note that these limits are subject to change and may be adjusted annually by the IRS. Keeping abreast of these changes is essential for effective financial planning. Additionally, it's worth highlighting that DCFSAs operate on a "use-it-or-lose-it" basis, meaning that any funds remaining in the account at the end of the year are forfeited. This makes strategic planning and accurate budgeting crucial for maximizing the benefits of these accounts.

Maximizing Your DCFSA: Strategies for Optimal Utilization

To get the most out of your DCFSA, it’s essential to employ a strategic approach. Here are some key strategies to consider:

- Accurate Budgeting: Start by assessing your annual dependent care expenses. This includes not only childcare costs but also potential expenses for elder care or special needs care. By understanding your anticipated expenses, you can contribute the optimal amount to your DCFSA, ensuring you maximize the tax benefits without incurring any penalties.

- Flexibility in Contributions: DCFSAs offer a unique advantage in that you can make contributions throughout the year, allowing for greater flexibility in your financial planning. Consider adjusting your contributions based on changing circumstances, such as the birth of a child or the need for additional caregiving support.

- Utilizing Pre-Tax Benefits: One of the primary advantages of DCFSAs is the ability to contribute pre-tax dollars. This means that your contributions are deducted from your pre-tax income, reducing your taxable income and potentially resulting in significant tax savings. Ensure you're taking full advantage of this benefit by contributing the maximum allowed amount.

Expanding the Horizons of DCFSAs: Beyond Childcare

While childcare remains a primary focus of DCFSAs, these accounts have evolved to offer a broader range of benefits. In recent years, there has been a growing recognition of the diverse needs of modern families, leading to an expansion of eligible expenses under DCFSAs.

Today, DCFSAs can be used to cover a wide array of dependent care expenses, including:

- Day care centers

- Nannies and babysitters

- After-school programs

- Elder care services for dependent parents or grandparents

- Special needs care for eligible family members

- Transportation costs associated with dependent care (e.g., taxi or ride-sharing services)

This expanded scope of eligible expenses offers a more comprehensive solution for families, allowing them to address a wider range of caregiving needs and expenses.

Special Considerations for Special Needs Care

For families with special needs dependents, DCFSAs can be an invaluable resource. These accounts can be used to cover a variety of expenses related to special needs care, including:

- Respite care services

- Special education programs

- Therapeutic activities and treatments

- Assistive devices and equipment

- Transportation costs for special needs care

By utilizing DCFSAs for special needs care, families can not only access critical services and supports but also potentially reduce their overall tax liability. It's important to consult with a financial advisor or tax professional to ensure you're maximizing the benefits of these accounts for your specific circumstances.

The Future of DCFSAs: Trends and Predictions

As we look ahead to the coming years, several trends and predictions can shape the future of DCFSAs. Here are some key considerations:

Increasing Flexibility and Accessibility

The ongoing evolution of DCFSAs is likely to focus on increasing flexibility and accessibility. This could include the potential for higher contribution limits, especially for families with multiple dependents or those facing high caregiving costs. Additionally, there may be a push for greater portability of these accounts, allowing individuals to carry over unused funds from one year to the next.

Integration with Technology

The digital age has brought about a revolution in financial services, and DCFSAs are no exception. We can expect to see a greater integration of technology into these accounts, with the development of mobile apps and online platforms that offer real-time account management and expense tracking. This enhanced digital presence could make DCFSAs more accessible and user-friendly, particularly for younger generations.

Expanding Eligibility Criteria

As society continues to evolve, so too will the definition of “dependent.” We may see a broadening of eligibility criteria for DCFSAs, potentially including non-traditional family structures and expanded definitions of caregiving. This could involve recognizing additional relationships, such as extended family members or chosen family, as eligible dependents.

Conclusion: Navigating the Complexities of DCFSAs

Dependent Care FSAs offer a crucial financial tool for working families, providing tax-advantaged funding for a wide range of dependent care expenses. As we approach 2025, it’s essential to understand the limits, benefits, and strategies associated with these accounts to maximize their potential.

By staying informed about the evolving landscape of DCFSAs, accurately budgeting for your dependent care expenses, and employing strategic contribution strategies, you can make the most of these accounts. Whether you're a parent navigating childcare costs or a caregiver supporting elderly family members, DCFSAs can be a valuable resource in managing your financial responsibilities.

As we look to the future, the continued evolution of DCFSAs promises to make these accounts even more accessible and beneficial. By staying engaged with the latest trends and predictions, you can ensure that you're positioned to take full advantage of these accounts, helping to balance the demands of work and family life.

Can I contribute to a DCFSA if I don’t have any eligible dependent care expenses this year?

+Yes, you can still contribute to a DCFSA even if you don’t anticipate having any eligible expenses this year. This is because DCFSAs operate on a “use-it-or-lose-it” basis, meaning any funds remaining in the account at the end of the year are forfeited. By contributing to the account, you can still benefit from the tax advantages of the FSA, and any unused funds can be a buffer for future eligible expenses.

Are there any penalties for exceeding the contribution limits for DCFSAs?

+Yes, exceeding the contribution limits for DCFSAs can result in penalties. If you contribute more than the allowed limit, you may be subject to a tax penalty and interest charges. It’s crucial to stay informed about the current contribution limits and adjust your contributions accordingly to avoid any potential penalties.

Can I use my DCFSA for expenses incurred before I opened the account?

+No, DCFSAs operate on a prospective basis, meaning you can only use funds for eligible expenses incurred after the account is opened. However, you can still contribute to the account and use those funds for future eligible expenses, providing a valuable source of tax-advantaged funding for your dependent care needs.