What Is The 1095C Form? A Comprehensive Guide

The 1095-C form is an essential document for employers and employees alike, as it plays a crucial role in reporting and verifying health care coverage under the Affordable Care Act (ACA). This form, officially known as the "Employer-Provided Health Insurance Offer and Coverage" form, is a critical component of the Internal Revenue Service's (IRS) efforts to ensure compliance with the ACA's provisions. In this comprehensive guide, we will delve into the intricacies of the 1095-C form, exploring its purpose, requirements, and implications for both employers and employees.

Understanding the Purpose of the 1095-C Form

The 1095-C form is designed to serve as a reporting tool for employers to provide detailed information about the health care coverage they offer to their employees. This form is a vital part of the ACA’s individual mandate, which requires most individuals to have minimum essential health coverage or face a penalty. By completing and filing the 1095-C form, employers help their employees meet this mandate by documenting the availability and nature of their health insurance plans.

The form itself is divided into three parts, each serving a specific purpose:

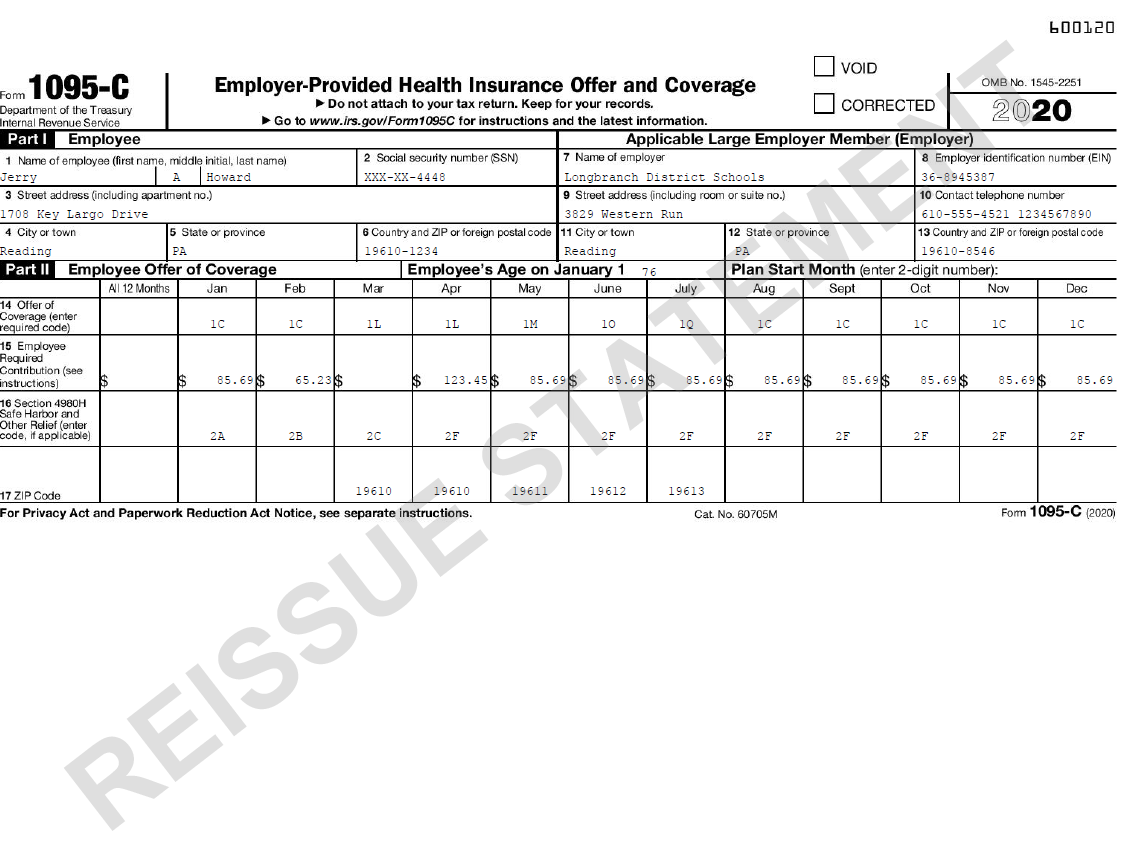

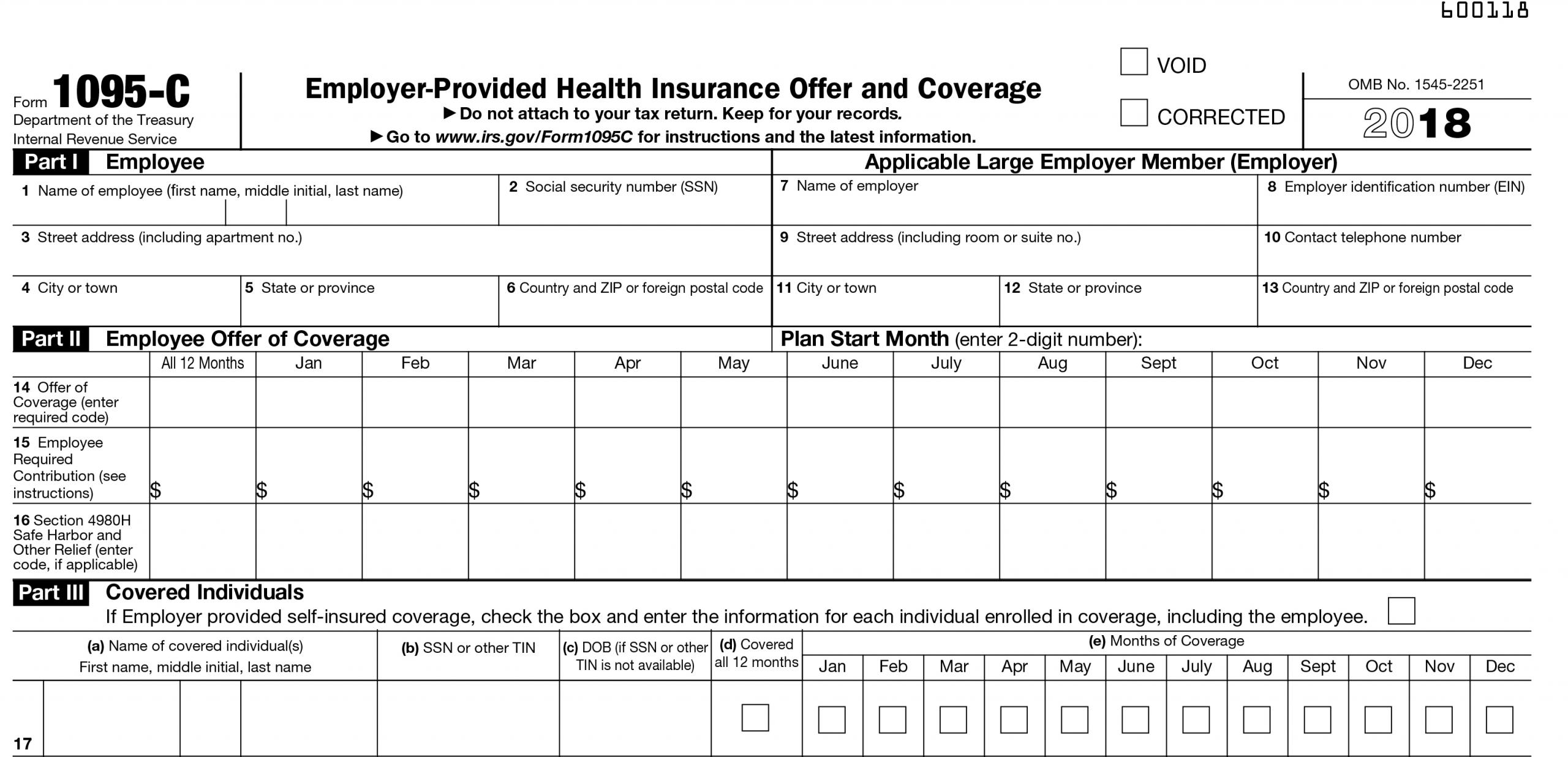

Part I: Employer Information

This section of the 1095-C form requires employers to provide basic information about their business, including their name, address, and Employer Identification Number (EIN). It also includes details about the employer’s health plan, such as the plan’s name, coverage type, and whether it is self-insured or fully insured.

Part II: Employee Information

Part II is dedicated to employee-specific details. Employers are required to list each employee’s name, date of birth, Social Security Number (SSN), and the months during which they were eligible for health coverage. This information is crucial for the IRS to verify an individual’s compliance with the ACA’s coverage requirements.

Part III: Coverage Information

In Part III, employers provide comprehensive details about the health coverage they offered to their employees. This includes the type of coverage (such as self-only, spouse, or family), the employee’s share of the premium cost, and any applicable coverage codes. This section ensures that the IRS can accurately assess the adequacy and affordability of the employer’s health plan.

Filing Requirements and Deadlines

The 1095-C form must be filed annually by employers who meet certain criteria. These criteria include:

- Having at least 50 full-time employees, including full-time equivalent employees, during the previous calendar year.

- Offering minimum essential coverage to at least one full-time employee during the year.

- Being an Applicable Large Employer (ALE) as defined by the IRS.

Employers must file the 1095-C form with the IRS and provide a copy to each full-time employee by the deadline, which is typically in early spring. It's important to note that the filing deadline may vary depending on whether the employer files electronically or on paper. Additionally, employers must ensure that the information on the form is accurate and up-to-date to avoid penalties.

Implications for Employers

Compliance with the 1095-C form requirements is not only a legal obligation but also carries significant implications for employers. Failure to file accurate and timely forms can result in penalties, which can be costly for businesses. The IRS imposes penalties for various infractions, such as failing to file, providing incorrect information, or not filing on time.

Moreover, the 1095-C form plays a crucial role in employer-employee relations. By providing employees with a clear understanding of their health coverage, employers can foster trust and transparency. This form also serves as a valuable resource for employees to verify their coverage and make informed decisions about their healthcare needs.

Employee Rights and Responsibilities

Employees have certain rights and responsibilities when it comes to the 1095-C form. Firstly, they have the right to receive a copy of the form from their employer, which provides them with crucial information about their health coverage. This transparency allows employees to assess whether they meet the ACA’s coverage requirements and take necessary actions if they do not.

Additionally, employees should carefully review the information on their 1095-C form to ensure its accuracy. Any discrepancies or errors should be reported to the employer promptly, as these can impact an individual's tax obligations and eligibility for certain tax credits or subsidies.

Technical Specifications and Reporting Codes

The 1095-C form contains various technical specifications and reporting codes that are essential for accurate reporting. These codes help the IRS categorize and process the information provided by employers. Some of the key codes and their meanings include:

| Code | Description |

|---|---|

| 1A | Self-only coverage |

| 1C | Employee and spouse coverage |

| 1E | Employee and family coverage |

| 2 | The employee's share of the premium cost |

| 1K | Employer-provided health coverage |

| 1H | Minimum essential coverage |

Employers must carefully select the appropriate codes based on the details of their health plan and employee coverage. Misclassification or incorrect coding can lead to penalties and compliance issues.

Performance Analysis and Metrics

The 1095-C form serves as a valuable tool for analyzing an employer’s performance in providing health coverage to its employees. By examining the data reported on the form, employers can gain insights into the effectiveness of their health plans and identify areas for improvement. Some key performance metrics to consider include:

- Percentage of employees enrolled in the health plan.

- Average employee contribution towards premium costs.

- Distribution of coverage types (self-only, spouse, family) among employees.

- Comparison of employer-provided coverage to industry standards or benchmarks.

Analyzing these metrics can help employers make informed decisions about their health benefits offerings, ensuring they remain competitive and compliant with the ACA's requirements.

Future Implications and Industry Trends

As the healthcare landscape continues to evolve, the 1095-C form and its reporting requirements are likely to adapt as well. The ACA, and by extension, the 1095-C form, have already undergone various modifications and updates since their inception. Keeping abreast of these changes is essential for employers to maintain compliance and adapt their health coverage strategies accordingly.

Industry trends suggest that there is a growing emphasis on employee well-being and the integration of wellness programs into health plans. Employers may explore innovative approaches to healthcare, such as telehealth services and personalized health coaching, to enhance the value of their coverage offerings. These trends are likely to influence the content and reporting requirements of the 1095-C form in the future.

Conclusion

The 1095-C form is a critical component of the Affordable Care Act’s reporting and compliance framework. It serves as a bridge between employers and employees, ensuring transparency and accountability in health coverage. By understanding the purpose, requirements, and implications of this form, employers can navigate the complex landscape of healthcare regulations while providing their employees with the information and coverage they need.

What happens if an employer fails to file the 1095-C form?

+Failing to file the 1095-C form can result in penalties imposed by the IRS. The penalty amount varies based on the number of employees and the nature of the infraction. Employers should prioritize compliance to avoid these penalties and maintain a positive relationship with their employees.

Can employees rely solely on the 1095-C form to verify their health coverage?

+While the 1095-C form provides valuable information about an employee’s health coverage, it is not the sole source of verification. Employees should also refer to their insurance cards, policy documents, and employer communications to ensure a comprehensive understanding of their coverage.

Are there any alternatives to the 1095-C form for reporting health coverage?

+Yes, there are alternative forms for reporting health coverage, such as the 1095-B form, which is used by insurers and certain government agencies. However, the 1095-C form is specifically designed for employers with at least 50 full-time employees and is the most common form used in this context.