Why Choose An Fsa Or Hsa? The Ultimate Guide

When it comes to healthcare planning and financial management, two popular options often come to the forefront: Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs). These accounts offer individuals and families a way to save and manage their healthcare expenses effectively. In this comprehensive guide, we will delve into the world of FSAs and HSAs, exploring their unique features, benefits, and how they can be tailored to meet your specific healthcare needs. By understanding the differences and advantages of each, you can make an informed decision and take control of your healthcare finances.

Understanding Flexible Spending Accounts (FSAs)

Flexible Spending Accounts, commonly known as FSAs, are a powerful tool for managing healthcare expenses. These accounts are designed to provide flexibility and control over your healthcare costs, offering a range of benefits that can significantly impact your financial planning.

How FSAs Work

FSAs are employer-sponsored accounts that allow employees to set aside a portion of their pre-tax income to cover eligible healthcare expenses. This pre-tax contribution reduces the employee’s taxable income, resulting in immediate tax savings. The funds in an FSA can be used to reimburse various healthcare-related costs, including copayments, deductibles, prescriptions, and even some over-the-counter medications.

Key Benefits of FSAs

- Tax Advantages: One of the most significant advantages of FSAs is the tax benefit. By contributing pre-tax dollars, you reduce your taxable income, which can lead to substantial savings, especially for individuals in higher tax brackets.

- Flexibility in Healthcare Expenses: FSAs offer flexibility in managing healthcare costs. You can use the funds to cover a wide range of expenses, providing peace of mind and financial relief during unexpected medical situations.

- Dependents’ Coverage: FSAs often extend coverage to dependents, including spouses and children, allowing you to manage their healthcare expenses as well.

- Quick Reimbursement: The reimbursement process for FSAs is generally straightforward and efficient. You can submit claims for eligible expenses and receive reimbursement promptly, ensuring you have the funds when needed.

Types of FSAs

There are two primary types of FSAs: Healthcare FSAs and Dependent Care FSAs. Healthcare FSAs focus on covering medical expenses, while Dependent Care FSAs are designed to assist with the cost of caring for dependents, such as childcare or eldercare.

FSAs vs. Other Healthcare Accounts

FSAs differ from other healthcare accounts like Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs). While FSAs provide flexibility and immediate tax benefits, they also come with a “use-it-or-lose-it” policy, meaning any funds remaining at the end of the plan year may be forfeited. This is where HSAs can offer an alternative, providing a more long-term savings option.

Exploring Health Savings Accounts (HSAs)

Health Savings Accounts, or HSAs, are another popular choice for individuals seeking control over their healthcare expenses. HSAs offer a unique combination of tax advantages and long-term savings potential, making them an attractive option for those with a strategic financial mindset.

The Basics of HSAs

HSAs are tax-advantaged accounts specifically designed to be used in conjunction with High Deductible Health Plans (HDHPs). These accounts allow individuals to save pre-tax dollars for qualified medical expenses, providing a way to manage healthcare costs while also building a financial cushion for the future.

Key Features of HSAs

- Tax-Advantaged Contributions: Similar to FSAs, HSAs offer tax benefits on contributions. The funds contributed to an HSA are made with pre-tax dollars, reducing your taxable income and providing immediate tax savings.

- Rollover and Long-Term Savings: One of the most significant advantages of HSAs is the ability to roll over funds from year to year. Unlike FSAs, HSAs do not have a “use-it-or-lose-it” policy, allowing you to accumulate savings over time. This makes HSAs an excellent option for long-term healthcare planning.

- Investment Opportunities: HSAs offer the potential for investment growth. You can invest the funds in your HSA, providing an opportunity to grow your savings and potentially earn higher returns over time.

- Qualified Medical Expenses: HSAs can be used to cover a wide range of qualified medical expenses, including deductibles, copayments, and prescription medications. Additionally, HSAs can be used to pay for future medical expenses, making them a versatile tool for healthcare management.

HSAs and Retirement Planning

HSAs not only provide short-term healthcare benefits but also play a crucial role in retirement planning. The funds in an HSA can be used to cover healthcare expenses during retirement, providing a tax-efficient way to manage medical costs in your later years. This makes HSAs a valuable addition to any comprehensive retirement strategy.

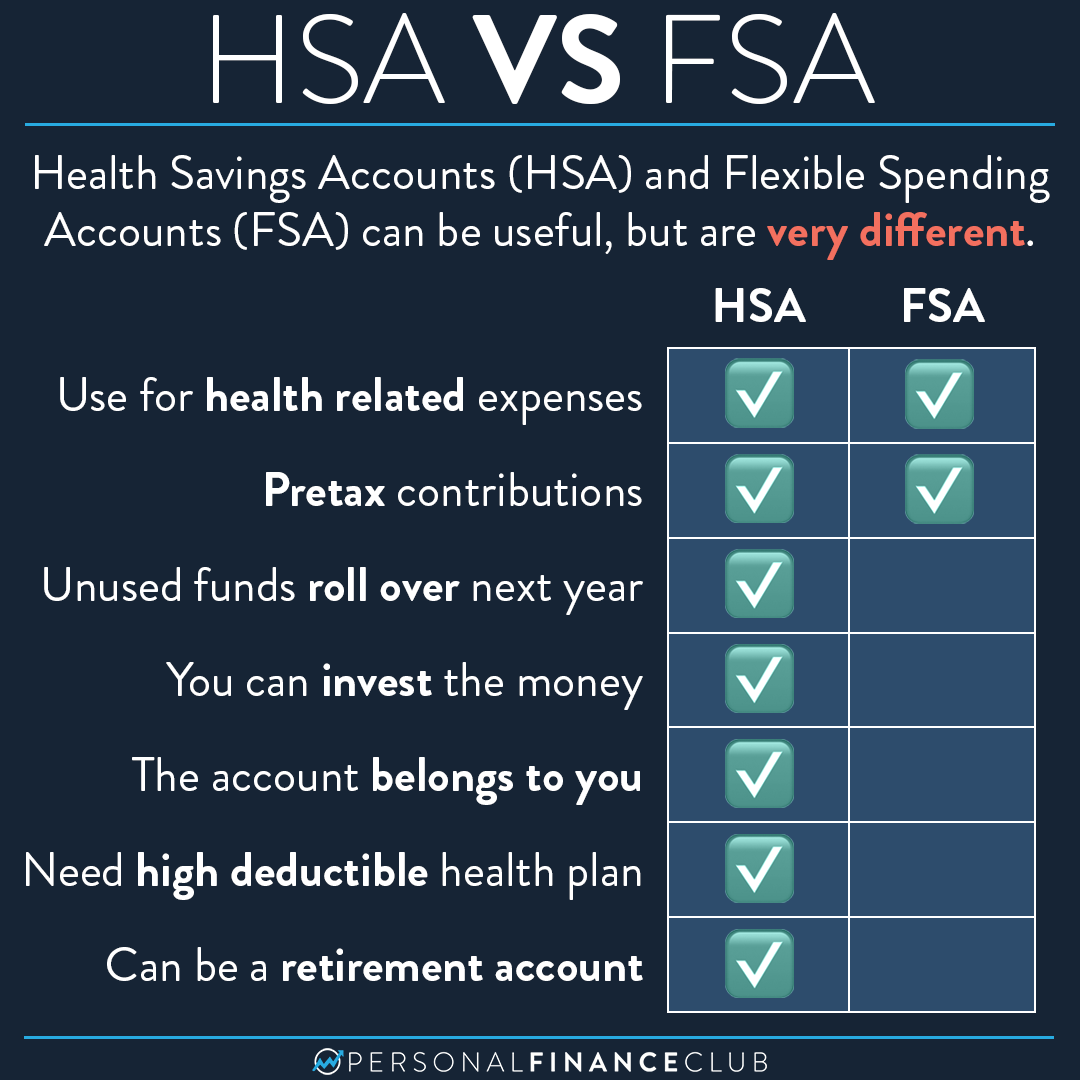

Comparing FSAs and HSAs

While both FSAs and HSAs offer tax advantages and flexibility in managing healthcare expenses, they have distinct differences. FSAs provide immediate tax benefits and flexibility but may require careful planning to avoid forfeiting unused funds. HSAs, on the other hand, offer long-term savings potential, investment opportunities, and the ability to carry over funds from year to year, making them an attractive choice for those looking to build a substantial healthcare savings fund.

Maximizing the Benefits: Tips and Strategies

To make the most of your FSA or HSA, it’s essential to understand how to optimize these accounts for your specific needs. Here are some tips and strategies to consider:

Estimating Healthcare Expenses

When deciding between an FSA and an HSA, it’s crucial to estimate your annual healthcare expenses. FSAs are ideal for those with predictable and consistent medical needs, while HSAs are more suitable for individuals with higher deductibles and the potential for long-term savings.

Understanding Eligible Expenses

Both FSAs and HSAs have specific guidelines for eligible expenses. Take the time to understand what expenses are covered under each account to ensure you maximize your benefits. From prescription medications to dental procedures, knowing what you can reimburse is essential.

Strategic Contribution Planning

Plan your contributions strategically. Consider your healthcare needs and financial goals when deciding how much to contribute to your FSA or HSA. Regularly review and adjust your contributions to align with any changes in your healthcare situation.

Exploring Investment Options (HSAs)

If you choose an HSA, explore the investment options available. Investing your HSA funds can help grow your savings and provide a more substantial financial cushion for future healthcare needs. Consult with a financial advisor to understand the best investment strategies for your HSA.

Utilizing FSA or HSA Benefits

Make the most of your FSA or HSA by utilizing the benefits they offer. From submitting claims for eligible expenses to taking advantage of tax-free withdrawals for qualified medical costs, ensure you are actively managing your account to maximize its potential.

Real-Life Success Stories

To illustrate the impact of FSAs and HSAs, let’s explore some real-life success stories of individuals who have effectively utilized these accounts to manage their healthcare finances.

Story 1: The Family’s Healthcare Journey

The Smith family, consisting of parents and two young children, opted for an FSA to manage their healthcare expenses. With consistent medical needs, such as regular doctor visits and prescription medications, the FSA provided them with the flexibility to cover these costs easily. The tax benefits allowed the family to save significantly, and they were able to maximize their FSA contributions each year.

Story 2: Long-Term Healthcare Planning

Mr. Johnson, a single individual with a high deductible health plan, chose an HSA to align with his long-term healthcare goals. By contributing consistently to his HSA, he built a substantial savings fund over time. The ability to invest his HSA funds provided Mr. Johnson with the potential for growth, and he plans to use these savings to cover future medical expenses, especially during retirement.

Story 3: Navigating Unexpected Medical Costs

Ms. Garcia, a young professional, faced an unexpected medical emergency. Fortunately, she had an FSA to help cover the costs. The flexibility of the FSA allowed her to reimburse various expenses, including hospital stays, surgeries, and follow-up care. The tax benefits of the FSA provided much-needed financial relief during a challenging time.

Future Implications and Trends

As healthcare and financial landscapes continue to evolve, FSAs and HSAs are likely to play an even more significant role in individuals’ lives. Here are some future implications and trends to consider:

Rising Healthcare Costs

With the cost of healthcare on the rise, FSAs and HSAs will become increasingly valuable tools for managing expenses. These accounts offer a way to offset the financial burden of medical care, providing individuals with greater control over their healthcare budgets.

Digital Integration

The integration of digital technologies into healthcare and financial management is expected to enhance the user experience of FSAs and HSAs. Mobile apps, online platforms, and streamlined reimbursement processes will make it easier for individuals to manage their accounts and access their funds quickly.

Expanded Eligibility

There is a growing trend towards expanding the eligibility criteria for FSAs and HSAs. This means more individuals, including those with certain chronic conditions or specific healthcare needs, may qualify for these accounts, providing a broader range of people with access to tax-advantaged healthcare savings.

Increased Awareness and Education

As awareness of FSAs and HSAs grows, individuals are becoming more educated about their financial options for healthcare. Employers and financial institutions are playing a crucial role in providing information and resources to help individuals make informed decisions about their healthcare finances.

Can I have both an FSA and an HSA simultaneously?

+No, you cannot have both an FSA and an HSA at the same time. These accounts serve different purposes and have specific eligibility criteria. However, you can switch between them based on your healthcare needs and financial goals.

Are there any penalties for not using all the funds in my FSA?

+Yes, FSAs typically have a “use-it-or-lose-it” policy, meaning any funds remaining in your account at the end of the plan year may be forfeited. However, some employers offer a grace period or allow you to carry over a limited amount to the next year.

Can I use my HSA funds for non-medical expenses?

+No, HSA funds are intended solely for qualified medical expenses. Withdrawing funds for non-medical purposes may result in penalties and taxes. It’s important to understand the eligible expenses covered by your HSA to avoid any penalties.