11 Financial Strategies To Cut Ut Austin Costs

The University of Texas at Austin (UT Austin) is a renowned public research university, offering a diverse range of academic programs and opportunities. However, the cost of attending this prestigious institution can be a significant concern for many students and their families. In this comprehensive guide, we will explore 11 effective financial strategies to help cut costs and make your UT Austin experience more affordable.

1. Explore Scholarships and Grants

Scholarships and grants are an excellent way to reduce your out-of-pocket expenses. UT Austin offers a variety of merit-based and need-based scholarships, as well as external scholarships from private organizations and foundations. Take the time to research and apply for these opportunities. The Texas Educational Opportunity Grant and the UT Austin Presidential Scholarship are notable options to consider.

Additionally, explore scholarships based on your field of study, extracurricular activities, or unique talents. For instance, the William Randolph Hearst Endowed Scholarship supports students pursuing degrees in engineering, architecture, or business.

| Scholarship | Amount |

|---|---|

| Texas Educational Opportunity Grant | $500 - $5,100 |

| UT Austin Presidential Scholarship | Up to full tuition |

| William Randolph Hearst Endowed Scholarship | Varies |

Pro Tip: Start your scholarship search early and create a dedicated folder to organize your applications. Many scholarships have specific requirements and deadlines, so staying organized is key.

2. Maximize Financial Aid

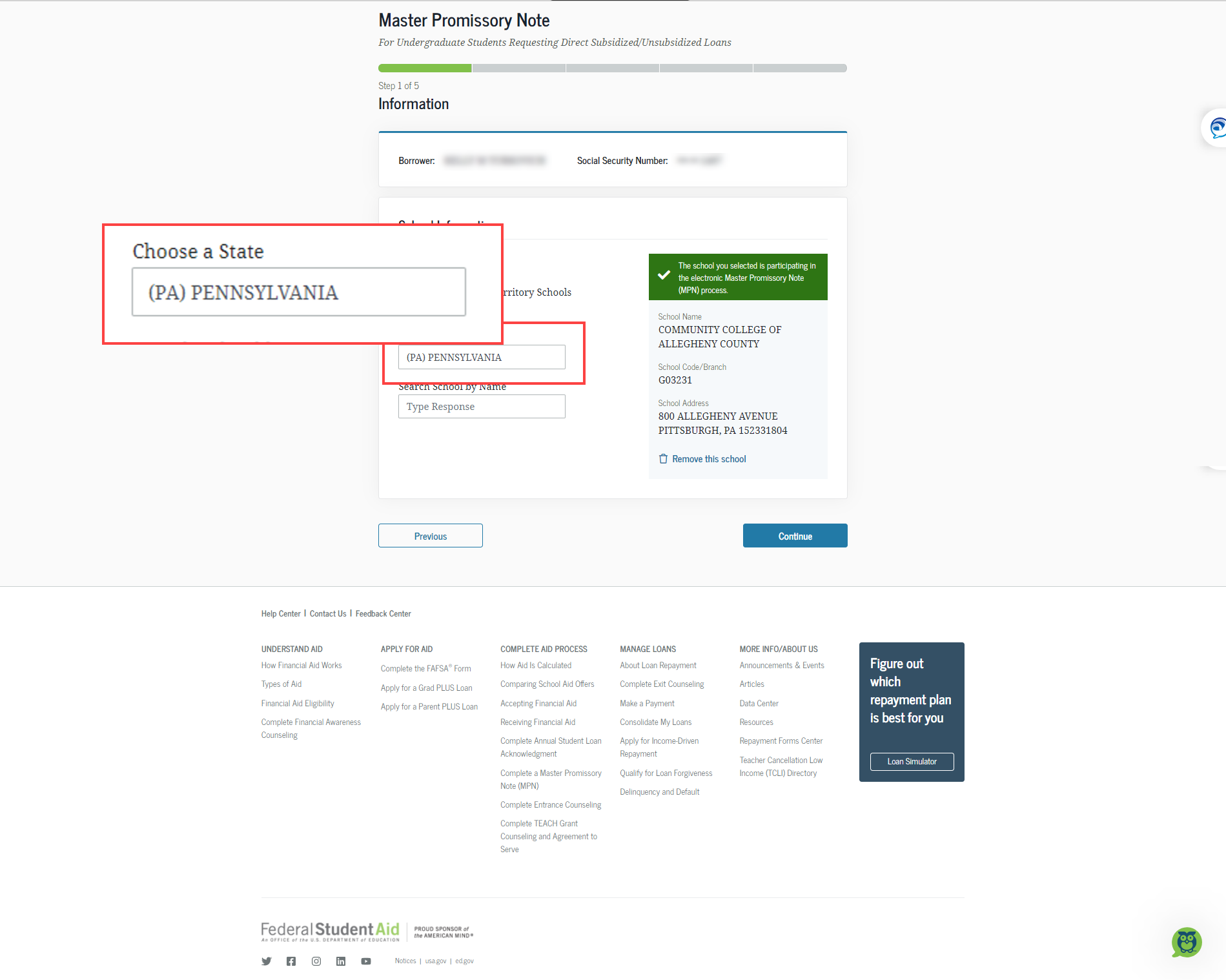

Financial aid is a crucial component of making college affordable. Complete the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for federal grants, work-study programs, and loans. UT Austin also offers its own financial aid packages, including the Hornbacker Grant and the Longhorn Promise Scholarship, which provide significant financial support to eligible students.

Make sure to meet all financial aid deadlines and provide any required documentation promptly. Stay in touch with the financial aid office to ensure you are taking advantage of all available resources.

Key Takeaway: Financial aid can significantly reduce your costs, so don't overlook this essential step in your financial planning.

3. Choose an Affordable Housing Option

Housing costs can quickly add up, so it’s essential to make smart choices. Consider living off-campus, as it often offers more affordable options compared to on-campus housing. Share an apartment or house with roommates to further reduce expenses. UT Austin provides resources to help students find suitable off-campus housing, such as the Off-Campus Housing Portal, which lists available rentals in the area.

If you prefer on-campus housing, explore the various residence halls and apartment-style options. Compare the costs and amenities of each to find the best fit for your budget. Keep in mind that some residence halls offer meal plans, which can be convenient but may not always be the most cost-effective choice.

| Housing Option | Average Cost per Semester |

|---|---|

| On-campus residence hall (with meal plan) | $6,000 - $8,000 |

| Off-campus apartment (shared) | $4,500 - $6,000 |

| On-campus apartment-style housing | $5,500 - $7,500 |

Expert Advice: Before committing to a housing option, create a budget to understand your financial needs and priorities. This will help you make an informed decision that aligns with your financial goals.

4. Take Advantage of Meal Plans (if Applicable)

Meal plans can be a convenient and cost-effective way to manage your food expenses, especially if you choose a plan that suits your dietary needs and preferences. UT Austin offers a variety of meal plan options, ranging from flexible dining dollars to all-you-can-eat dining halls. Compare the costs and benefits of each plan to find the best fit for your budget and lifestyle.

Consider the following factors when choosing a meal plan:

- Your daily food consumption and dietary requirements.

- The convenience and flexibility of the plan.

- The cost per meal and any additional fees.

- Any discounts or promotions offered by the university.

Meal Plan Options at UT Austin:

| Meal Plan | Description | Cost |

|---|---|---|

| Dining Dollars | Flexible plan with dining dollars to spend at various on-campus restaurants. | $2,000 - $3,000 per semester |

| All-Access Plan | Unlimited meals at select dining halls. | $3,500 - $4,000 per semester |

| Block Plans | Pre-paid meals with a set number of swipes per semester. | $2,500 - $3,000 per semester |

5. Seek Work-Study Opportunities

The Federal Work-Study program provides part-time employment opportunities for students with financial need. These jobs often offer flexible schedules and valuable work experience. UT Austin participates in the Work-Study program, offering positions on campus and with community organizations.

Benefits of Work-Study include:

- Earning money to help cover educational expenses.

- Gaining valuable work experience and networking opportunities.

- Developing time management and organizational skills.

- Potential for career exploration and discovery.

To be considered for Work-Study, complete the FAFSA and indicate your interest in the program. The financial aid office will guide you through the application process and help you find suitable job opportunities.

Note: Work-Study positions are limited, so apply early to increase your chances of securing a position.

6. Explore Part-Time Jobs

In addition to Work-Study, consider exploring part-time jobs on or off-campus. UT Austin offers a variety of employment opportunities, including positions in research labs, administrative offices, and campus services. These jobs can provide valuable work experience and a steady income to help cover expenses.

When searching for part-time jobs, keep the following in mind:

- Balance your work and study commitments to avoid burnout.

- Look for jobs that align with your interests and career goals.

- Consider the commute time and location of the job.

- Negotiate your wages and hours to ensure a fair and manageable schedule.

Online job boards and career centers can be excellent resources for finding part-time work. UT Austin's Career Engagement Center provides job listings and support for students seeking employment.

Pro Tip: Create a professional resume and cover letter to enhance your job applications. Highlight your skills, experiences, and academic achievements to stand out to potential employers.

7. Save on Textbooks

Textbooks can be a significant expense, but there are strategies to reduce costs. Consider the following options:

- Rent or buy used textbooks from online retailers or campus bookstores.

- Explore open-source textbooks and educational resources available online.

- Check out textbooks from the university library or borrow from classmates.

- Participate in textbook swaps or buy/sell groups on social media.

UT Austin's Campus Bookstore offers a wide selection of new and used textbooks, as well as rental options. Compare prices and consider the condition of used books to make an informed decision.

Textbook Savings Tips:

- Compare prices from multiple sources before making a purchase.

- Consider the resale value of textbooks when choosing to buy or rent.

- Look for digital versions or e-books, which are often more affordable.

- Join a textbook exchange group to save money and connect with other students.

8. Utilize Campus Resources

UT Austin offers a wealth of resources and services that can help you save money. Take advantage of the following:

- UT Libraries: Access a vast collection of books, journals, and online resources for free.

- Campus Health Services: Receive medical care and prescription medications at reduced rates.

- RecSports: Enjoy access to fitness facilities and recreational activities at a discounted rate.

- Career Engagement Center: Get support for your job search and access to exclusive job opportunities.

Explore the university's website and campus directories to discover all the resources available to you. Many of these services are included in your student fees, so make the most of them to save money and enhance your college experience.

Campus Resource Savings:

| Resource | Savings |

|---|---|

| UT Libraries | Free access to books and resources |

| Campus Health Services | Reduced rates for medical care |

| RecSports | Discounted access to fitness facilities |

9. Travel Smart

If you commute to campus or travel frequently, consider these tips to save on transportation costs:

- Use public transportation or carpool with classmates to reduce fuel expenses.

- Explore discounted student travel options for flights and hotels.

- Consider a bike or scooter for short-distance travel around campus.

- Use ride-sharing apps or public transportation for longer trips.

UT Austin's Transportation and Parking Services provides information on parking permits, shuttle services, and alternative transportation options. Take advantage of these resources to find the most cost-effective way to get around.

Transportation Savings:

- Carpooling or public transportation can save you up to $100 per month on fuel costs.

- Student discounts on flights and hotels can reduce travel expenses by 10-20%.

- Biking or using a scooter can be a cost-effective and environmentally friendly option.

10. Practice Smart Spending

Making conscious choices about your spending habits can significantly impact your overall expenses. Here are some tips to help you save:

- Create a budget and track your spending to identify areas for improvement.

- Cook at home or pack meals instead of eating out frequently.

- Look for student discounts at local businesses and entertainment venues.

- Use cash or a debit card instead of credit cards to avoid debt.

Consider using budgeting apps or spreadsheets to monitor your finances. UT Austin's Financial Wellness Program offers resources and workshops to help students develop healthy financial habits.

Budgeting Tips:

- Allocate your income based on your priorities, such as tuition, housing, and living expenses.

- Set aside a portion of your income for emergencies and unexpected expenses.

- Automate your savings by setting up regular transfers to a dedicated savings account.

11. Plan for the Future

While it’s important to focus on immediate cost-cutting measures, planning for the long term is crucial for financial stability. Consider the following strategies:

- Save for future semesters or unexpected expenses.

- Research and apply for internships or research opportunities that offer stipends or housing.

- Explore study abroad programs that provide financial aid or scholarships.

- Consider part-time or summer jobs to boost your income.

By planning ahead, you can reduce financial stress and make informed decisions about your academic and career path.

Future Planning Tips:

- Set financial goals and create a plan to achieve them.

- Research and compare graduate school or professional programs to make an informed decision.

- Start building your professional network to explore future career opportunities.

How can I find the best scholarship opportunities for me?

+Researching scholarships can be overwhelming, but there are a few strategies to make it easier. Start by searching for scholarships specific to your field of study, extracurricular activities, or unique talents. Utilize online scholarship databases and scholarship search engines to find relevant opportunities. Attend scholarship workshops or meet with a financial aid advisor to get personalized guidance. Additionally, reach out to your high school or community organizations for local scholarship opportunities.

What are some tips for finding affordable off-campus housing?

+When searching for off-campus housing, consider the following tips: Start your search early to have a wider range of options. Look for housing near public transportation to save on commuting costs. Compare rental prices and amenities to find the best value. Consider sharing an apartment or house with roommates to split the rent and utilities. Use UT Austin’s Off-Campus Housing Portal and online rental platforms to find listings.

How can I make the most of my meal plan?

+To get the most value from your meal plan, consider these tips: Choose a plan that aligns with your dietary needs and preferences. Take advantage of all-you-can-eat dining halls to maximize your meals. Use dining dollars wisely by comparing prices at different on-campus restaurants. Avoid wasting meals or dining dollars by planning your meals and tracking your spending. Explore off-campus dining options to compare prices and find cost-effective alternatives.