Jobs About Finance

The world of finance is a dynamic and exciting field, offering a multitude of career opportunities for individuals with diverse skill sets and interests. From traditional roles in banking and investment to more specialized positions in risk management and financial technology (fintech), the finance industry provides a platform for professionals to make a significant impact on the global economy. In this article, we will explore the diverse landscape of finance jobs, delving into the responsibilities, qualifications, and prospects associated with each role. By the end of this comprehensive guide, you will have a clearer understanding of the vast array of career paths available in the world of finance and the steps you can take to embark on a rewarding and successful financial career.

Traditional Finance Roles: Building the Foundation

The bedrock of the finance industry, traditional finance roles, have long been the gateway for many professionals to enter the world of finance. These roles, often considered the foundation of the industry, provide a solid understanding of financial principles and practices, forming the basis for more specialized career paths.

Banking Professionals: Custodians of Capital

Banking professionals play a pivotal role in the financial ecosystem, acting as custodians of capital and facilitators of economic transactions. The primary responsibility of bankers is to manage and safeguard the financial assets of individuals, businesses, and institutions. This involves a range of tasks, including opening and maintaining accounts, processing transactions, offering financial advice, and providing access to credit facilities.

The qualifications for banking roles vary depending on the specific position and the institution. However, a strong foundation in finance, accounting, or economics is typically preferred. Many banks also value soft skills such as communication, customer service, and problem-solving abilities. Additionally, staying abreast of industry regulations and maintaining a high level of integrity are essential aspects of a banker’s role.

Investment Specialists: Navigating the Markets

Investment specialists are the navigators of the financial markets, guiding individuals and institutions through the complex world of investments. These professionals are responsible for managing and growing the financial assets of their clients by making informed investment decisions. This involves analyzing market trends, researching companies, and developing investment strategies that align with the client’s financial goals and risk tolerance.

To become an investment specialist, a deep understanding of financial markets, investment products, and economic principles is essential. Many professionals in this field hold advanced degrees in finance, economics, or business, coupled with industry-specific certifications such as the Chartered Financial Analyst (CFA) designation. Additionally, strong analytical skills, decision-making abilities, and a keen understanding of risk management are vital for success in this role.

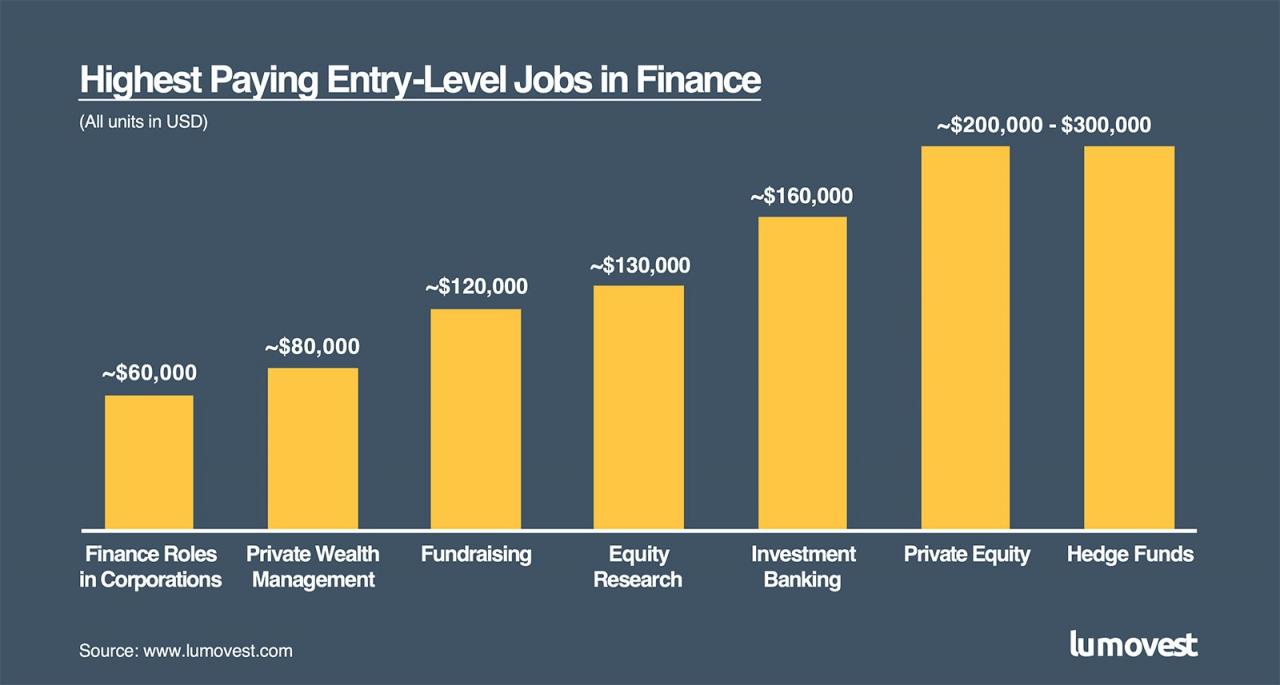

Specialized Finance Roles: Exploring Niche Opportunities

While traditional finance roles provide a solid foundation, the finance industry also offers a plethora of specialized roles that cater to specific interests and skill sets. These niche opportunities allow professionals to delve deeper into particular areas of finance, often requiring advanced expertise and a unique skill set.

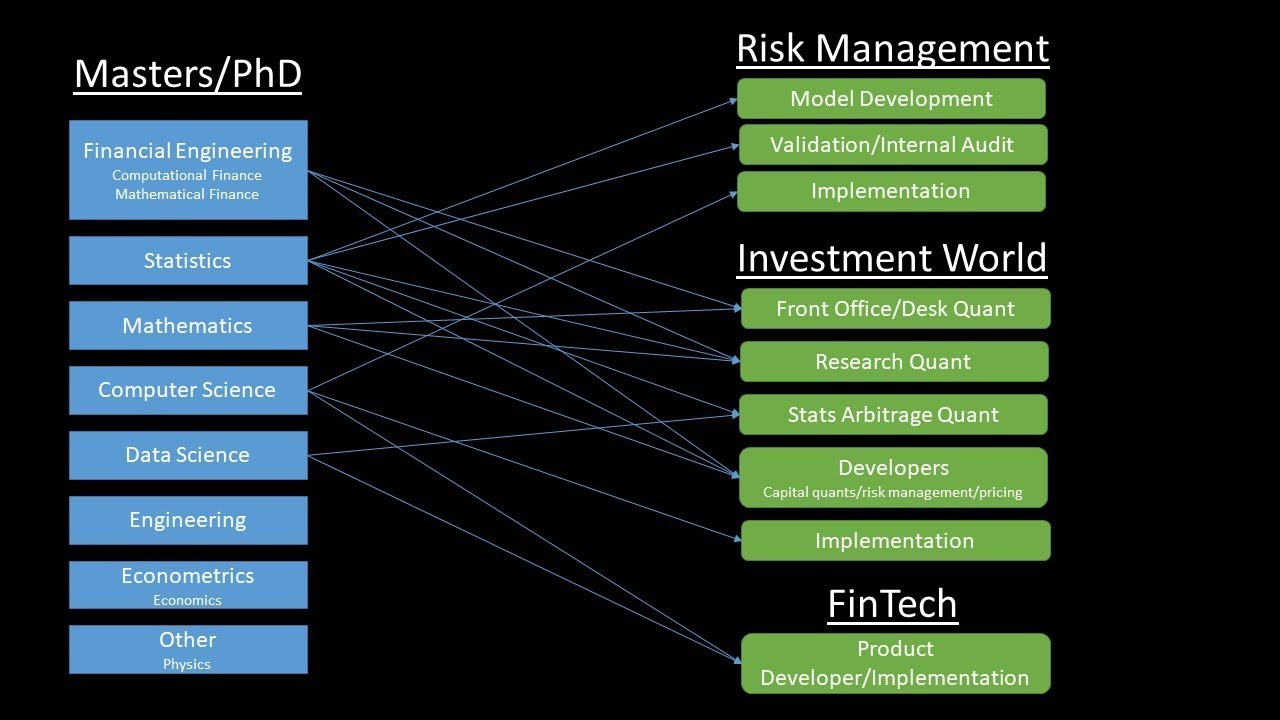

Risk Management Experts: Mitigating Financial Risks

Risk management is a critical aspect of the finance industry, and risk management experts play a vital role in identifying, assessing, and mitigating potential financial risks. These professionals work across various sectors, including banking, insurance, and investment, to ensure that organizations are prepared for and can navigate potential financial challenges.

The qualifications for risk management roles often include a strong background in finance, coupled with specialized knowledge in risk management principles and practices. Many professionals in this field hold advanced degrees in finance or risk management, along with industry-specific certifications such as the Financial Risk Manager (FRM) designation. Additionally, strong analytical skills, attention to detail, and the ability to communicate complex risk scenarios to stakeholders are essential skills for risk management experts.

Financial Technology (Fintech) Professionals: Innovating Finance

The rise of financial technology, or fintech, has opened up a whole new realm of career opportunities in the finance industry. Fintech professionals are at the forefront of this revolution, leveraging technology to disrupt traditional financial services and create innovative solutions. These professionals work on developing and implementing cutting-edge technologies, such as blockchain, artificial intelligence, and machine learning, to enhance the efficiency and accessibility of financial services.

The qualifications for fintech roles often require a unique blend of financial expertise and technological skills. Many professionals in this field hold degrees in finance or economics, coupled with a strong background in computer science, data science, or engineering. Additionally, a deep understanding of emerging technologies and their potential applications in finance is crucial for success in fintech roles. The ability to think creatively, solve complex problems, and stay abreast of the latest technological advancements are key attributes of fintech professionals.

The Future of Finance Jobs: Embracing Change

The finance industry is undergoing a period of rapid transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. As a result, the future of finance jobs is likely to be characterized by a continued emphasis on innovation, digital transformation, and a focus on sustainability and ethical practices.

Embracing Digital Transformation

The digital revolution has already had a significant impact on the finance industry, and this trend is set to continue. Fintech companies and traditional financial institutions alike are investing heavily in digital technologies to enhance the customer experience, improve operational efficiency, and reduce costs. As a result, professionals with expertise in digital finance, data analytics, and cybersecurity are likely to be in high demand.

For those interested in pursuing a career in digital finance, a strong foundation in finance coupled with a deep understanding of emerging technologies is essential. This may involve obtaining a degree in finance or economics, along with specialized training or certifications in areas such as data science, blockchain, or cybersecurity. Additionally, staying abreast of the latest industry trends and best practices is crucial for success in this rapidly evolving field.

Focus on Sustainability and Ethical Practices

In recent years, there has been a growing emphasis on sustainability and ethical practices within the finance industry. As investors and consumers become increasingly conscious of the environmental and social impact of their financial decisions, financial institutions are being held to higher standards of accountability and transparency. As a result, professionals with expertise in sustainable finance, impact investing, and environmental, social, and governance (ESG) criteria are likely to be in high demand.

To pursue a career in sustainable finance, a strong foundation in finance or economics is typically required, coupled with specialized knowledge in sustainability and ESG principles. Many professionals in this field hold advanced degrees in sustainable finance or related disciplines, along with industry-specific certifications such as the Chartered Sustainable Investment Professional (CSIP) designation. Additionally, a deep understanding of the environmental and social challenges facing the world, coupled with a commitment to driving positive change, is essential for success in this emerging field.

Conclusion: A World of Opportunities in Finance

The world of finance offers a myriad of career opportunities, from traditional roles in banking and investment to specialized positions in risk management and fintech. Each role presents its own unique challenges and rewards, requiring a specific skill set and a deep understanding of financial principles. As the finance industry continues to evolve, professionals who embrace change, stay abreast of industry trends, and develop a diverse skill set will be well-positioned to thrive in this dynamic and exciting field.

Whether you’re just starting your career or looking to make a transition, the finance industry provides a wealth of opportunities to make a meaningful impact on the global economy. By exploring the diverse range of finance jobs, understanding the qualifications and skills required, and staying informed about industry trends, you can chart a successful and rewarding career path in the world of finance.

What are the key qualifications for a career in finance?

+The qualifications for a career in finance can vary depending on the specific role and industry. However, a strong foundation in finance, accounting, or economics is typically preferred. Many finance professionals hold advanced degrees, such as a Master’s in Finance or a MBA, coupled with industry-specific certifications. Additionally, soft skills such as communication, problem-solving, and analytical abilities are highly valued in the finance industry.

What are the growth prospects in the finance industry?

+The finance industry offers excellent growth prospects for professionals with the right skills and expertise. As the global economy continues to evolve, the demand for financial services and expertise is expected to grow. Additionally, the rise of fintech and digital transformation is creating new opportunities for professionals with a combination of financial and technological skills. However, it’s important to note that competition in the finance industry can be intense, and staying up-to-date with industry trends and best practices is crucial for career advancement.

What are the key challenges faced by finance professionals?

+Finance professionals face a range of challenges, including keeping up with the ever-changing regulatory landscape, managing risk effectively, and staying ahead of the curve in terms of technological advancements. Additionally, the pressure to make sound financial decisions and provide accurate advice to clients can be intense. However, with the right skills, knowledge, and a commitment to continuous learning, finance professionals can overcome these challenges and thrive in their careers.